Build-A-Bear Workshop v3.1: In the Corner

$BBW: Position update heading into '23 EoY and Jan '24

It’s approaching the end of the year, and I’ve been swamped tidying up loose ends. My focus has been on the McDonald’s trade around its Investor Day news and subsequent momentum events while trimming other profitable positions, namely, TSM and KO call positions not discussed here.

No, I haven’t forgotten about Build-A-Bear Workshop’s Q3 ER as I still do have a position as of December 27, 2023. I had to reread their ER transcript again prior to this post to grasp their reason for guiding down for ‘23 EoY. All in all, I will not mask my slight annoyance with the management's word-salad statements and its responses to the Q&A session during their Q3 ER call.

"Good but not great"

Key Data Points1:

Total revenues were $107.6 million and increased 2.9%

Net retail sales were $100.4 million and increased 1.2%

Consolidated e-commerce demand (online orders fulfilled from either the Company’s warehouse or its stores) increased 7.1%

Commercial and international franchise revenues were a combined $7.2 million and increased 36.2%

Diluted EPS was $0.53, a 3.9% year-over-year increase driven by pre-tax margin expansion and a reduction in share count, offset by an increase in tax rate.

EBITDA grew 3.0% to $13.3 million, or 12.4% of total revenues.

One key metric to focus on is its ability to consistently generate a margin percentage of 14-16% over the past three years. While impressive, the earnings fell short on two key variables: 1) the C-Suite's statement of 'unexpected softness;' and 2) the possible interpretation that its year-over-year revenue growth is contracting.

Nonetheless, I don't mind trading and owning a company with an EBITDA margin % hovering near 15% YoY. It's still impressive for a company that sells teddy bears made from synthetic materials abroad.

Q3 Earnings PR Fumble

However, when the stock is not widely covered by the Street, it’s imperative that every word said during the opening remarks for an earnings call is crisp and absent of ambiguity. Yet, the PR team fumbled:

As noted in this morning's press release, while we have revised our guidance to reflect some unexpected softness in the business starting in the latter part of October and continuing into November, we intend to stay focused on delivering our fourth quarter plans during the remainder of the most critical holiday shopping period as we continue to expect to deliver our third consecutive record-breaking year. Our results represent the best ever third quarter and first 9 months revenue and pretax income in Build-A-Bear history.

Starting out the CEO’s opening remarks with “softness” is how you leave a first impression on the quarter. Then during the Q&A, CEO John tried to clarify the “softness” as a result of general weakness in consumer spending due to macro headwinds. Then came this:

Definitely, as we talked about our results and our finish to Q3 was softer than what we expected. And as we mentioned in our November results only in the month have continued at that pace. But like later in November, and as we said right now as we are entering into December, our trends have reversed. So like we are contemplating that as we are projecting for our Q4 and fiscal year results EBIT in our guidance.

The opening remark should have started with meeting its EBIT fiscal guidance, not on some temporary weakness that reversed later in the quarter. On a bright side, did I mention the PEG is now at 0.22 post-earnings?

A possible special dividend announcement in ‘24?

I personally have some gripes about its lackluster business model, but that is for another day. It’s a very conservative management afterall.

In the short-term, I believe they have the bandwidth to announce another special dividend with their $25M and its cash from operation. The last special dividend was announced on March 22, 2023 in the amount of $1.50/share. However, I do not see one being announced before my calls expire in January ‘24.

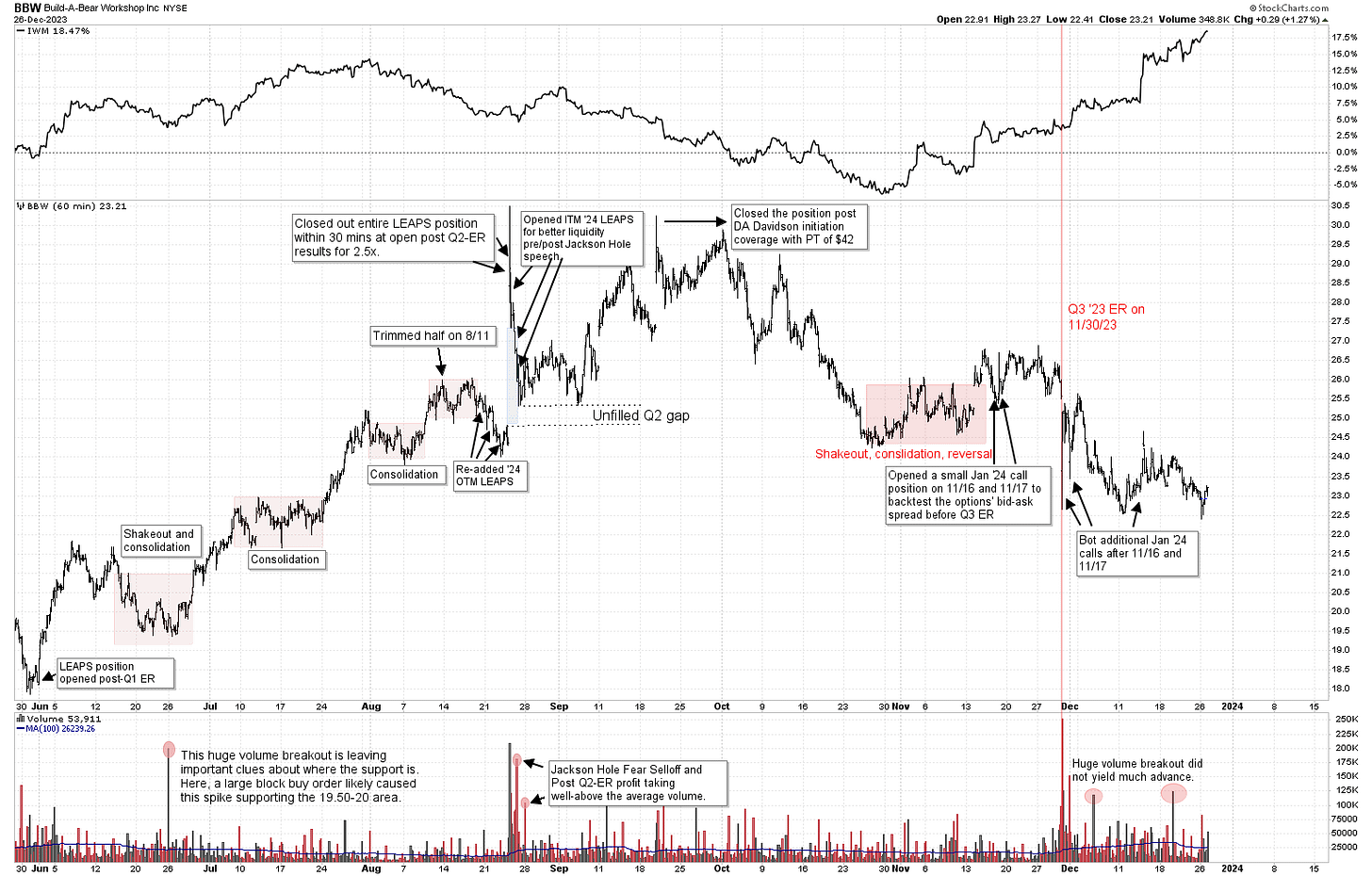

Surprisingly low volume & technical analysis

The Q3 earnings debacle exacerbated the sell-off in December, with the stock trading inversely to the Russell 2000 and diverging from other small-cap industry peers. Given the 13M shares float, it's likely that tax loss selling and portfolio rebalancing on low volume are the culprits behind the recent pullback in the stock price.

I’ve been adding ‘23 January calls since mid-November and post Q3 earnings on seasonality and on signs of technical reversal.

BBW’s Volume and Candlestick Analysis

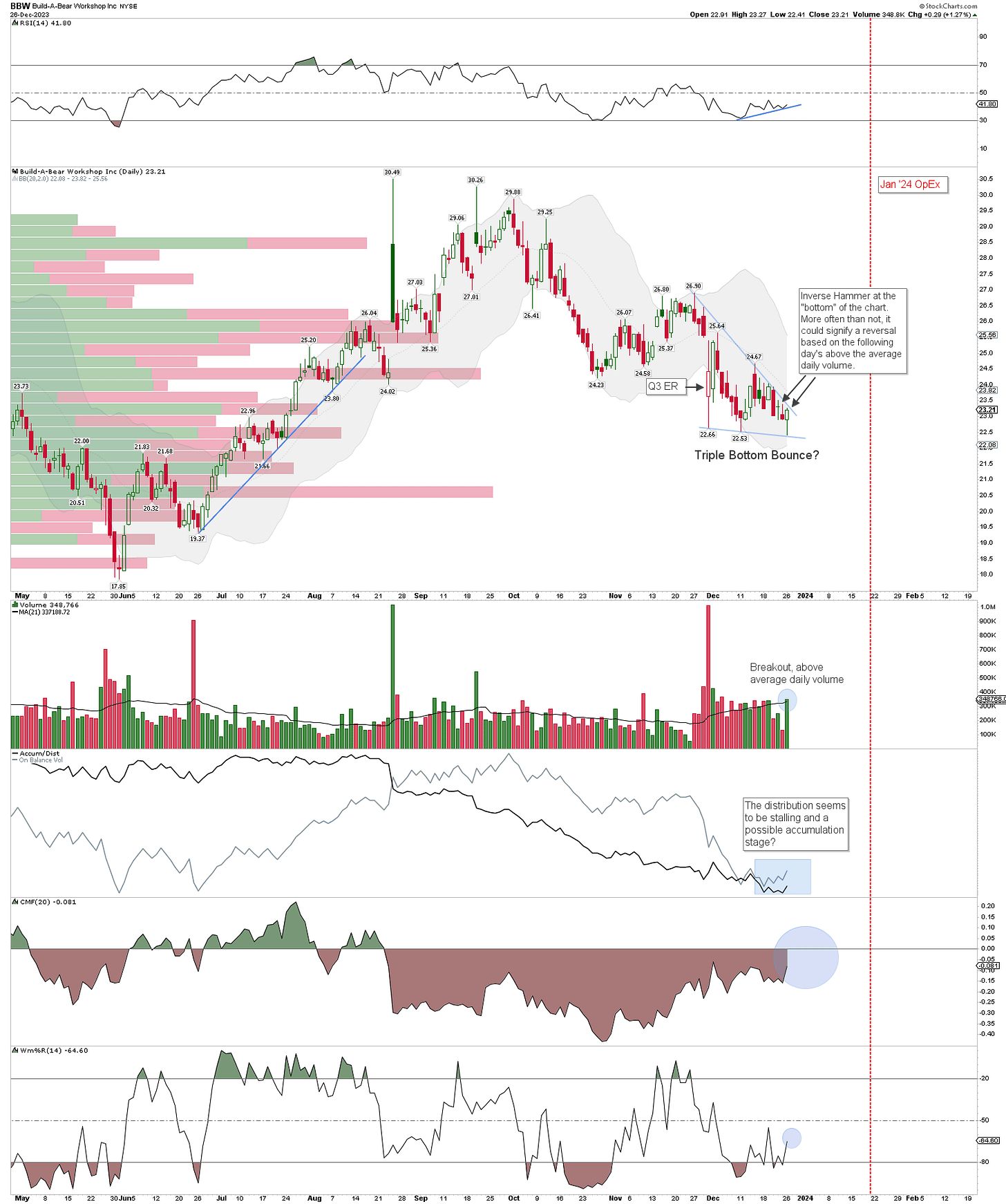

I've annotated some technical markers that could indicate a reversal from the current closing price of $23.21. In the last session on December 22, there was an Inverse Hammer candlestick on the daily chart, followed by a strong Hammer with above-average volume on December 26.

Furthermore, it is showing signs of accumulation after forming a possible Triple Bottom pattern, which is a bullish reversal chart pattern that typically appears after a downtrend. However, it's important to note that these are just crumbs on the chart, indicating a probability of a reversal — a “more than likely” chance.

Position going into Jan ‘24

I hold OTM calls expiring in January ‘24, and this trade carries certain risks associated with the trade, notably, liquidity and low delta. As these contracts are out-of-the-money, the sole value of the contract premiums are derived from time value. Thus, the success of the the trade hinges on strong volume orders pushing Vega higher, i.e., IV on premium, on the assumption that it never goes in-the-money.

All in all, my bet is on a reversal in the coming weeks.

Disclaimer: I have a long position in BBW, with OTM calls expiring on January 19, 2024. This is a very risky trade but I can stomach volatility.

https://ir.buildabear.com/news-releases/news-release-details/build-bear-workshop-reports-third-quarter-fiscal-2023-results