Why Delta?

In trading options, delta and theta are the most important Greeks to know.

Delta illustrates how much an option price will move in relation to a $1 change in the stock price. Theta tells us how much an option’s premium will decay on a daily basis.

Sometimes, you have to pay for the good stuff.

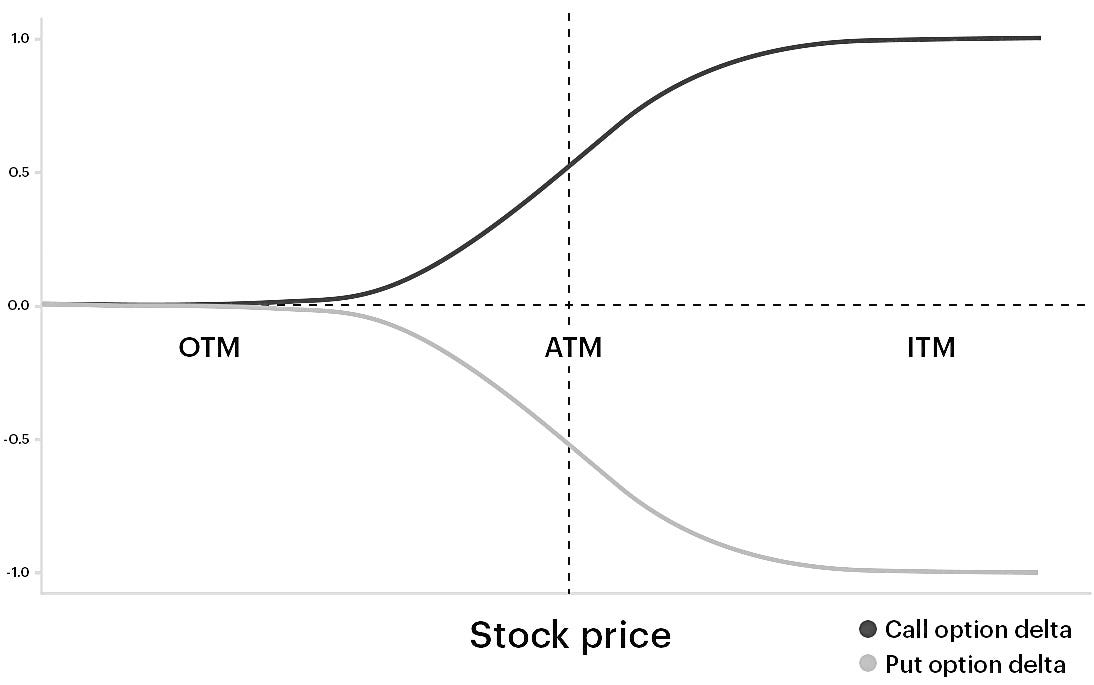

Delta values range from 0 to 1 — also equivalent to 0 percent to 100 percent. The higher the delta on the contract, the more closely the options prices will mimic the movement of the stock price.

In other words, Delta measures how much an option’s price can be expected to move for every $1 change in the price of the underlying security or index. For example, a Delta of 0.55 means the option’s price will theoretically move $0.55 for every $1 change in the price of the underlying stock or index. That’s why delta matters.

The closer the stock price is to the strike price of the options, the higher the delta and the premium.

This is my approach to establishing positions in options that mirror the underlying securities without paying the full retail price. Occasionally, I enter arbitrage trades using Out-of-the-Money contracts with lower delta to capitalize on the disconnect between market sentiment and low implied volatility before a significant corporate event.

Bar none, Delta is the key to configuring the right options trade.