Starbucks v1.1: Speculator's Tale Post-Q4 ER

$SBUX: Winning and losing at the same time – and the upcoming weeks

The Q1 Earnings Report was better than the Street feared.

It’s been a whirlwind of emotions in the past several days after Starbucks reported its Q4 earnings. Was it stellar? No. However, it did “exceed” the Street's expectations by not announcing an apocalypse in China. It missed the Street’s EPS estimate of $0.94, reporting $0.90 actual, and a revenue estimate of $9.6 billion compared to $9.4 billion. As I mentioned in my previous post, much of the earnings hinged on CEO Narasimhan’s outlook comments and the reaffirmation of its fiscal year guidance.

For a company that profits from foot traffic to its stores, I find it amusing that it has been able to increase its global operating margin in double digits and boost its EPS by more than 20% YoY in the midst of Middle East turmoil. That said, it was CFO Ruggeri’s commentary on strong foot traffic that, I believe, calmed the Street:

Overall, our traffic continues to be strong and it's growing. So, when you look at the success of our performance in the quarter, particularly in the US, our highest-ever average weekly sales were driven by a combination of strength in traffic, but also strength in overall ticket. And we saw a record number of customers coming into our stores and spending a record amount. Now, those customers are both our Rewards customers as well as our non-Starbucks Rewards customers. So, we're seeing growth in our customer base across our segments and that's driving strong performance as each customer is spending more.

I was glued to the after-hours chart when the comment was made, propelling the stock 3-4% during the Q&A session. It’s not to say that the management gave a stellar outlook, given various headwinds mentioned. Nevertheless, it exceeded the Street’s expectations, despite falling short on both top and bottom lines.

All in all, I was pleased with my speculative thesis and nailing most of them: 1) the worst was priced in; 2) comparable sales were 5%, higher than what most assumed at 4%; and 3) 7% growth internationally, particularly strong numbers from China.

But the market never ceases to amaze when I thought I’ve seen it all

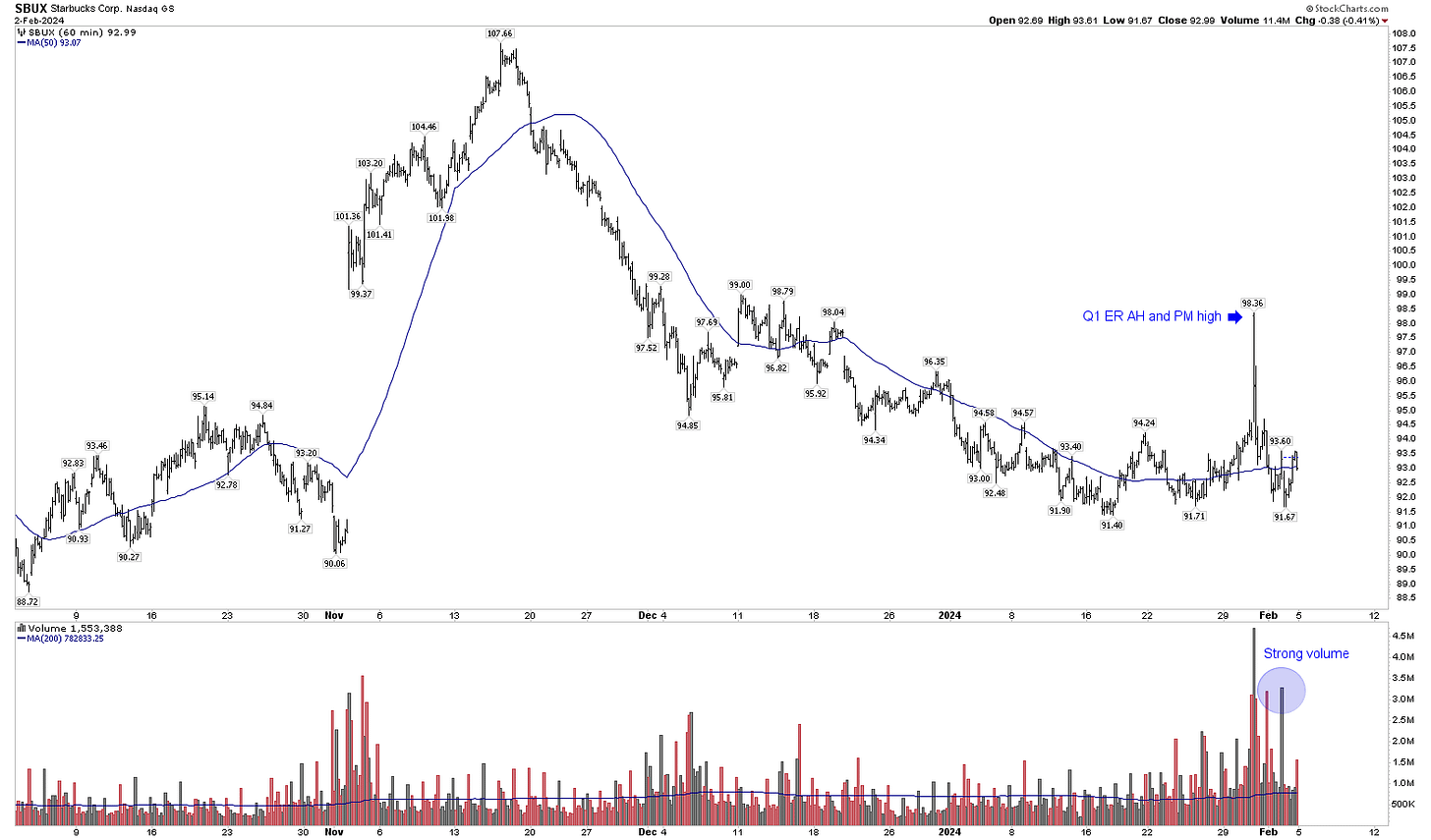

Throughout after-hours and pre-market following the earnings call, there was strong volume, with the stock price reaching $98.36 in premarket trading, 4-5% gain. However, the situation took a sharp turn at the market open when Google's subpar cloud business results negatively affected market sentiment, just before the FOMC released its statement on rates. At the open on January 31, Starbucks experienced a sell-off in large block orders despite showing strong volume in the pre-market, which is often indicative of a manipulation campaign aimed at generating liquidity for large positions to exit.

Implied Volatility glitched, Vega crushed, and Bid-Ask Spread Broke

What a horrid sight it was at open for the options chain and my feeble mind could not immediately grasp what was occuring before my eyes. Here’s how the March $100 calls behaved:

Hours before the ER on January 30, the contract was trading around $1.50.

At open for a few seconds a few contracts sold for $2.09, a 39% gain. By any standard, this is a meager gain compared to the underlying gap-up open.

Starbucks opened at $98.36, only to head down lower to $93.11 by 11:30am.

The said contract premium crashed from $2.10 to $0.46 by 11:30am.

As long as I've traded options, I've never seen the contract premium at open unable to calibrate to the Greeks correctly. My immediate reaction was that perhaps my ThinkorSwim was experiencing a temporary glitch, but no.

My educated guess is that there were pending large Market-On-Open sale orders that needed to be filled, while inexperienced traders bought in after seeing the AH/PM volume. However, the demand could not overcome the supply in that split second, causing the Vega to crush. Subsequently, the underlying sold off after that initial reaction.

In the industry, we call this bullshit.

Another oddity was the Historical Implied Volatility on these contracts. They were released in December, so the Greeks adjusted to a thin set of data going back merely three months. In my experience, the longer contracts have been trading in the market, the higher the likelihood that the premium will align with the correct theoretical value.

My fumble was underestimating the options market makers' ability to erode the premium outside $1-2 deviation from the current price. I could blame the OMMs or the market for this oversight, but ultimately, I'm fully responsible for my own trades. Again, I should’ve recognized that it lacked the historical data to gauge future implied volatility. It took me several days to come to terms with what had happened, and I now acknowledge that it was an outlier, a two sigma event – but not all hope is lost, at least not yet. It's just a small bump on the road.

Onto the Technicals

With the ex-dividend date on February 8 and the general market being bullish for the week, it experienced one of the largest gains in months, at 3.42% on the 6th, settling above both the EMA-13 at 93.46 and the EMA-65 at 95.21. For reference, most dividend stocks tend to surge leading into the ex-date and pull back slightly on the day of, since it's the last day to be a “record holder.” But I digress.

My favorite moving averages, the daily EMA 13 and 65, are about to cross over. I've been told that they're also institutions' favorite markers for blue-chip and dividend stocks. Additionally, the stock closed above the daily SMA 200 (97.14) for the first time since last August! The momentum is building, and it's a positive sign despite the options fiasco in the earnings report. It just means that OMMs are making it clear that out-of-the-money options have nothing but time value for the time being.

Another bullish aspect is that the weekly chart is hitting (almost) all the marks:

Weekly pivot point is at 98.87, an area that could propel higher upon settling above;

Weekly MACD curling;

Settled above WMA-10 (94.15) and WMA-30 (95.93);

Above average volume the past two weeks; and

Finally waiting for WMA-10 and WMA-30 to cross over.

It’s best to let it brew, as it’s a slower churning ship.

Sell Side Targets and Corporate Events

One crucial aspect for a retail trader like myself to be aware of, especially for a stock heavily owned by institutions, is how Street analysts perceive the stock after significant earnings reports. This is because their assessments often drive stock movements, rather than retail traders. The average price target set by analysts is $107.88, whereas the stock closed at $97.30 on February 9th, indicating a potential 10.87% upside from the current spot.

Here, Starbucks is owned 73% by institutions with remaining float held by retail. Except for Schultz who owns 1.9% of the outstanding shares, there are no other notable insiders. Again, this is an institutional “darling.”

Buyback. Furthermore, from October 2, 2023 to December 31, 2023, the company has repurchased 12,778,291 shares, representing 1.12% for $1,250.1 million. With this, the company has completed the repurchase of 670,188,630 shares, representing 48.52% for $34,946.31 million under the buyback announced on August 2, 2006.

I believe that $105 is within reach in the coming weeks – and potentially higher if we receive positive news regarding Apollo’s potential purchase of a minority stake in the Middle East, North Africa, and central Asia. Again, Starbucks mentioned that sales were significantly impacted by the conflict, both in the Middle East and in the U.S., as some ill-informed consumers launched protests and boycott campaigns, urging the company to take a stance on the issue. However, Starbucks' growth driver lies in its international segment.

It seemed fitting that an unusual LEAP order came in the day before Reuters dropped the news about Apollo. I don’t believe options orders are random coincidences; rather, they often represent a microcosm of a future event and capitalize on the market's surprise factor. Well, at the very least, it churned the volume for the week.

TL;DR

Let it brew.

Disclaimer: I have Starbucks calls in my portfolio. Enter at your own risk. This is not for boy scouts, nor is it financial advice.