$PTON Peloton is not dead *yet*

Not just a "stationary bike with an iPad"

This article was originally published on August 19, 2024 before Peloton’s Q4 earnings report on X via @GeorgeC1953

Slow day at the office, usually the case mid-August, so here's something I've been mulling over the weekend. Here's a long, boomer post and it's been awhile.

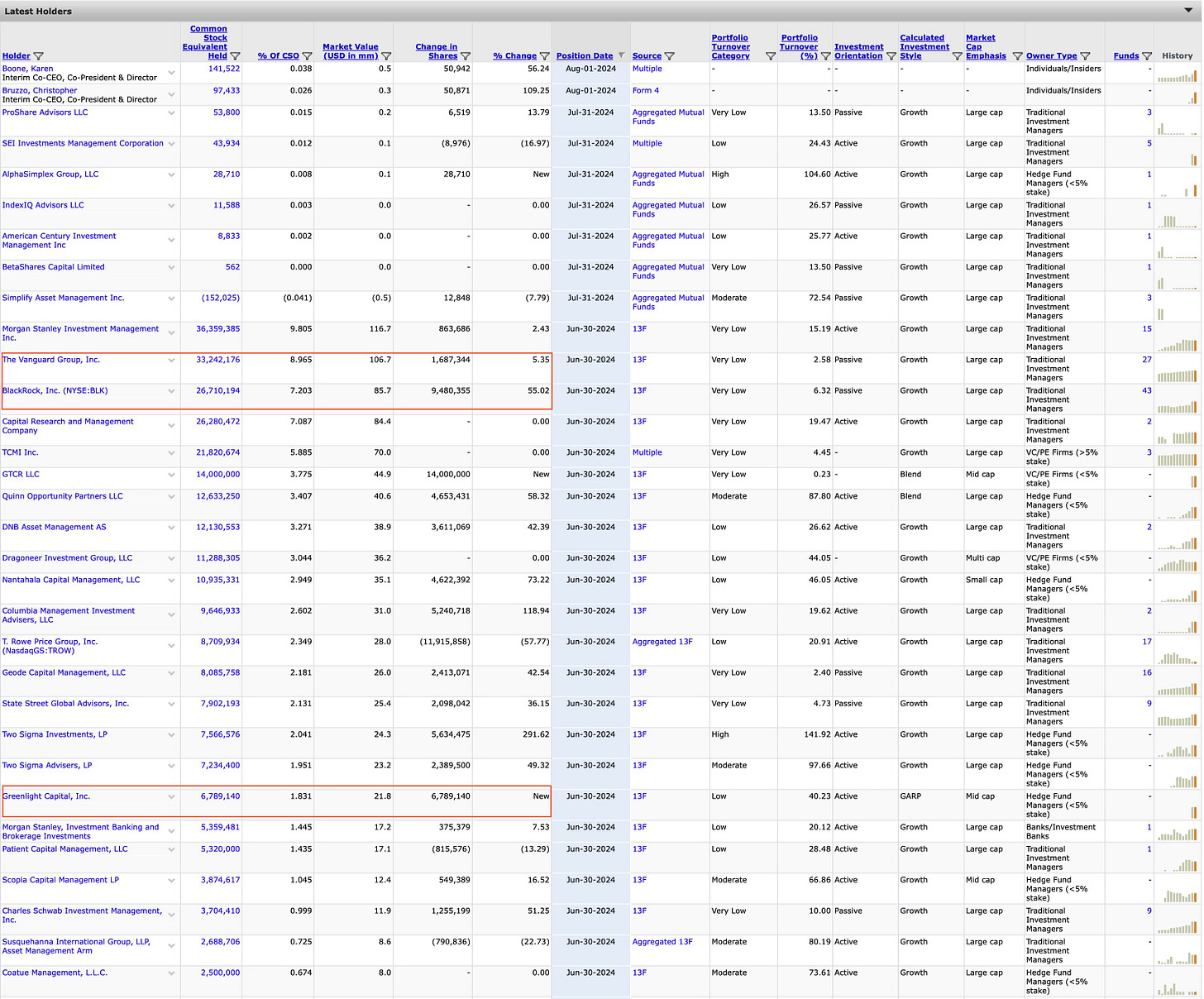

13Fs - Large Institutions

I spent some time digging through Peloton's financials, earnings, and disclosures. What initially piqued my interest was going through the recent 13F disclosures, notably BlackRock, Greenlight, and GTCR accumulating shares last Q.

BlackRock "buys everything" but for a passive fund it has increased its stake by 55%, representing 9.5M shares. Einhorn's new position with 6.7M shares is also notable for a classic "value" investor. Lastly, GTCR, a PE firm, opened a whopping position with 14M shares. What are they seeing that the retail is not?

While I do enjoy trading degen contracts, I’ve made the most money speculating on potential takeover bids, also my specialty in my legal practice. The idea of Peloton as a takeover target isn’t new. However, many are overlooking the fact that the fundamentals need to be strong before a takeover can happen.

My thesis on recent buying sprees by both passive and active funds is that Peloton’s interim leadership is turning the ship around—now generating positive free cash flow for the first time in over 3 years. The takeover thesis might be secondary to its fundamental shift in my view. Nonetheless, if a takeover does happen, I think I have an idea of which company it might be.

Q3 Highlights

Q3 Earnings dropped some crumbs as to what's to come in the coming quarters:

New permanent CEO will likely to be announced shortly – but I won't hold my breathe on whether they'll announce the new CEO during Q4 ER;

Continued positive Free Cash Flow via cost reduction and debt refinancing; and

Strong subscriptions:

We ended Q3 with 3.06 million paid connected fitness subscriptions, reflecting a net increase of 52,000 in the quarter. Average net monthly paid connected fitness subscription churn was 1.2%, which outperformed internal expectations...Our revenue consisted of $438 million of subscription Segment revenue, which represents 61% of total revenue, and $280 million of Connected Fitness segment revenue.

The average consumer sees Peloton primarily as a hardware company—essentially a “bike with an iPad”—but in reality, it’s a content company first and an equipment company second. They have a very loyal connected fitness subscriber base with 1.2% average net monthly churn as of Q3, which leads to my next point.

Partnership with Google

One recent news that did not get much traction was Peloton's partnership with Google on August 13th, a multi-year, multi-country partnership to offer a wide portfolio of Peloton classes to Fitbit Premium users, starting in early September. Google has been focusing on its health products with a history of buying out peripheral equipment companies. See Fitbit. Thus, if Peloton is to be bought out, it's likely to be Google in my opinion. Just an educated guess based on their platform synergy.

All in all, this solid statement from the CFO should give some comfort for a runway this year:

First off, I'm pleased that we have finally achieved the critical milestone of becoming free cash flow positive. And I am confident that we will be able to sustain it on a full year basis for fiscal year 2025. I'm also optimistic about the prospect of restructuring our debt and eliminating any potential concerns about the timing of our debt maturity.

Dogshit balance sheet *for now*

Peloton used net proceeds from the notes and new credit facilities to strategically repurchase approximately $800 million of 0% convertible senior notes due in 2026 at a discount, to refinance its existing term loan and revolving credit facilities.

So there's light at the end of the tunnel with their cost restructuring plan; it is to achieve $200M in run rate savings by the end of '25 and a significant share of those costs reductions are taking place immediately. Music to my ears.

Peloton Short Interest

Short interest has been increasing, which is understandable given the broken sentiment around this name. I don’t want to draw a direct comparison to Carvana before its turnaround, but the shorts covering played a large role in creating a reversal on the chart.

The best opportunities often arise when a situation appears dire—seemingly on the brink of bankruptcy—yet finds a way out. I would argue that last quarter’s positive FCF is that inflection point. Imagine if they report another quarter of positive FCF on August 22.

Sell-side's PTs are also pure dogshit

There isn’t much love from the Street, but the lower the expectations, the easier it is to surprise the herd.

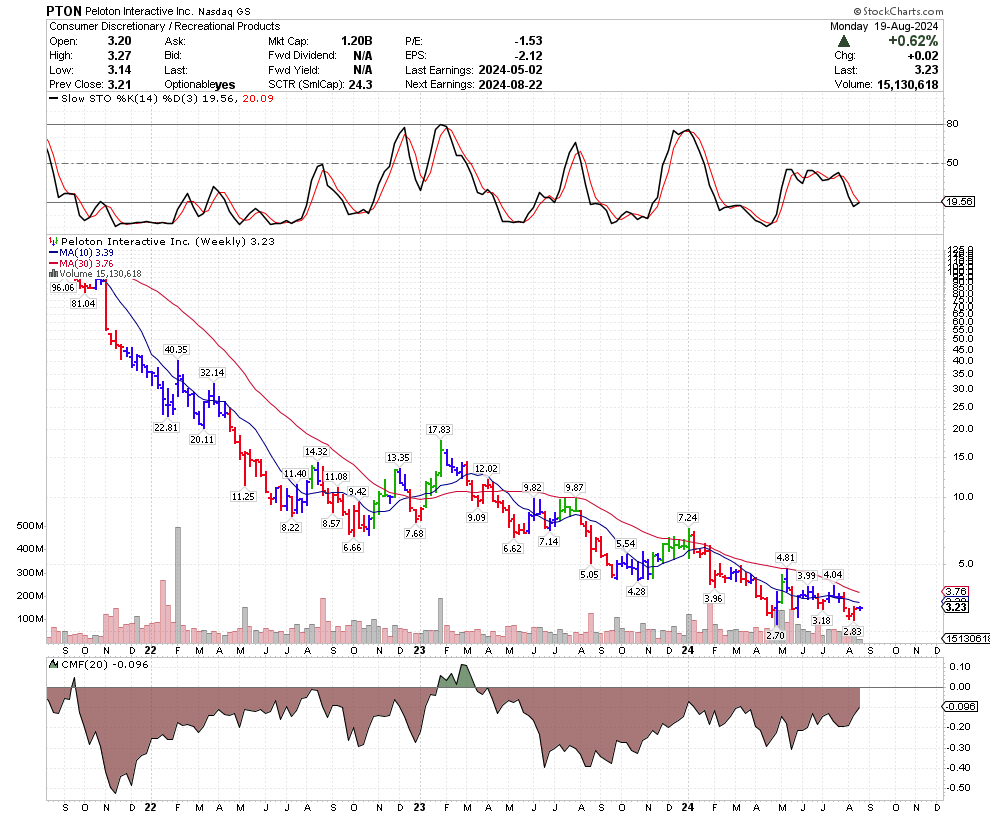

Log scale chart necessary because it's shit

Without log-scale, there is no other way to see the weekly chart. As horrific as the chart seems, the chart is consolidating between $2.70 and $4. It's very likely that the aforementioned institutions added and/or opened their positions in this range; thus, there's institutional support around this area.

Peloton LEAPS for '25 and '26

Time and patience. That's it.

Either a fundamental turnaround or a takeover bid takes time, though I’d argue that a takeover will take longer than most assume. I’ve been involved in these deals, and they require many man-hours just to hash out the discovery and due diligence, including FCPA matters. As I’ve alluded, a fundamental turnaround always comes before a takeover bid, which, again, also takes time.

I’m personally liking December ’25 or January ’26 OTM calls around $5 or $7, as implied volatility has less impact on LEAPS after earnings. I think the best approach is to buy a few here and there, gradually building a position and then just waiting. Remember, it’s the sitting and waiting that make you money, right?

Q4 earnings are coming up on August 22nd. I plan on holding a few calls going in. I can stomach the volatility, but this is not for boy scouts.