McDonald's v11.3: Investor Day Position Update

$MCD: Boost from Dalio, McRib, China, and key moving averages

I’ve been away on work matters and am finally getting a chance to finish this McDonald’s post I’ve been wanting to update for a week. It’s been a strong month after all.

Dalio’s 13F filing for Q3 2023: Upping the stakes in McDonald’s

Dalio’s firm has been heavily increasing its stake in consumer staples and discretionary the past several quarters. This includes its stake in McDonald’s in Q3 together with KO and COST. His firm’s 13F was released on November 16 giving strong boost and volume to McDonald’s price action that day.

McRib news percolating throughout the news outlets

As a student of the market for years, I’ve come to believe that the timing of release of good news is of no coincidence. Livermore used to call these “campaigns” to disseminate news that would benefit the Deep Pockets at the precise moment. Today, these campaigns are done through the release of headlines that grab the attention of institutional investors with access to Bloomberg Terminal. MarketWatch headlines generally dominate the newscycle and the McRib’s story compounded the volume on November 16.

McDonald’s to Acquire Carlyle's Stake in Its China Operation

Likely due to private equity woes in China, McDonald’s and Carlyle Group mutually agreed upon McDonald's acquiring the 28% ownership stake in the strategic partnership that operates and manages its business in mainland China, Hong Kong and Macau. Previously this minority ownership stake was held by Carlyle. McDonald's will remain a minority partner while increasing its stake from 20% to 48% ownership.

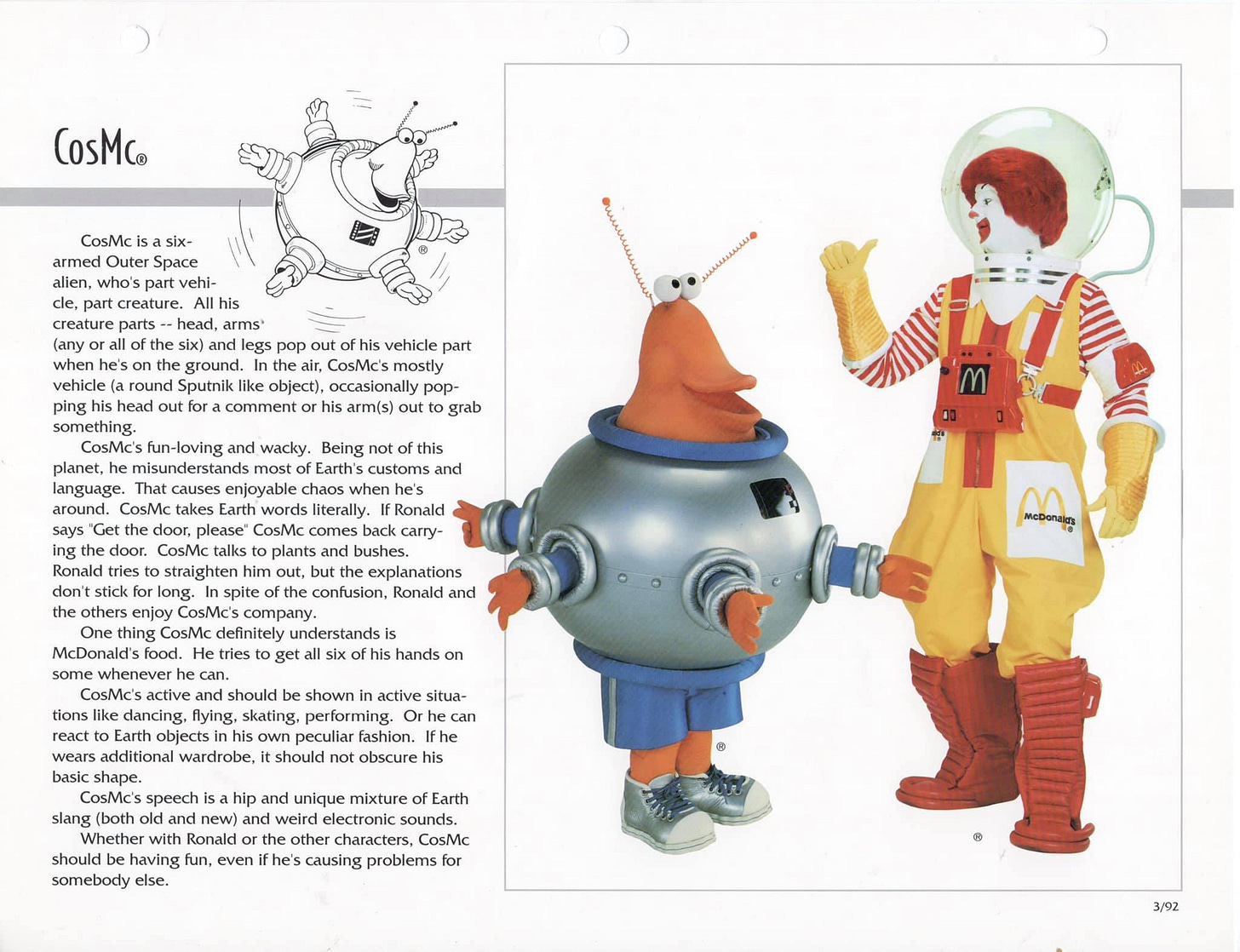

Investor Day likely to reveal the new concept restaurant: CosMc’s

McDonald’s has been working on a new restaurant concept called "CosMc," which it revealed during its Q2 ER call on July 27. They will be tested in a small handful of sites in a limited geography beginning early next year.

CosMc’s pays tribute to the six-armed alien-robot hybrid character of the same name that relocated to McDonaldland after discovering McDonald’s burgers and fries. Based on a few spy photos taken near MCD HQ, it’s giving off Dutch Bros-vibe, possibly focusing on drive through custom drinks and carry out experience. This is a game changer for a legacy company that has thrived on the mantra, “if it ain't broke, don't fix it.”

It’s my guess that MCD will announce the news on December 6 during the Investor Day presentation. I’m also uncertain whether the market has priced in CosMc’s news for 2024, given its consolidation and distribution in the $280-282 area.

Position Update as of 11/29

I’m only human — and instead of cutting losses during the Ozempic Panic from $280 to $245, I doubled down on OTM ‘24 calls on its reversal and trimmed half of my position for 170% profit on November 22.

Catching a falling knife is considered one of the deadly sins in trading, particularly with commons. It’s something I still struggle with to this day because who doesn’t suffer from the sunk cost fallacy? One exception to this common rule, however, arises when the chart shows signs of accumulation and basing for a reversal. The reward can be worthwhile if a trader can recognize this reversal early on and take the risk on the relative strength and volatility inherent in options by averaging up. This, of course, assumes that fundamentals and growth acceleration remain the same.

Increasing MCD position leading into Investor Day on December 6

Today, November 30, is ex-dividend so it has a tendency to pullback for a few days. But this is also a great opportunity to add if in options with the upcoming Investor Day presentation on CosMc’s.

Technically, I see a short term retest of the MA-30 area between $277-280 but my PT of $295 still stands before the year. Whether breaking through $300 will depend on Kempczinski‘s optimism for FY2024.

I’m excited for next week.

Disclaimer: I have OTM ‘24 calls in my portfolio. Enter at your own risk, seriously. This is not for boy scouts.

George, I have learned to much from you. I value all your posts on here and on X.

interesting ... thank you!