Beat on both top and bottom lines

I needed a full day to digest the superb Q3 earnings results1 on October 30th and to listen to the earnings call to fully form an opinion on its likely trajectory before the end of the year – and also review the sell-side revisions on their price targets.

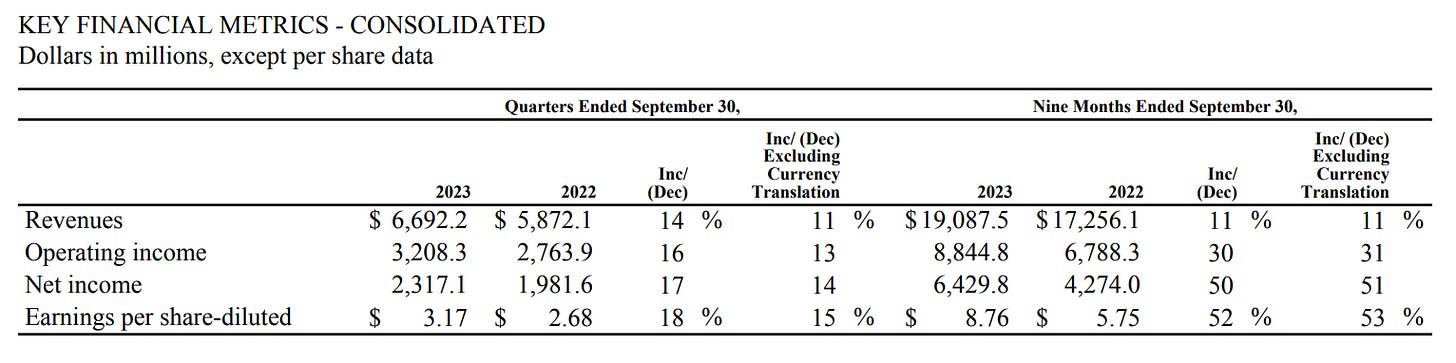

As I’ve alluded in my previous post regarding its Q3 EPS and revenue, it came darn close to my expectations. The Street’s consensus was $2.99 EPS and $6.55B in revenue; actual earnings per share was $3.17, an increase of 18%, with revenue of $6.69B.

Global Systemwide sales increased 11% for the quarter, with global comparable sales of nearly 9%. Frankly, I'm thoroughly impressed with their execution in the U.K., Germany, and Canada, where they achieved the highest comparable sales.

Earnings call focused on succeeding in a tough macro environment

The theme that repeated throughout the earnings call was a “challenging macro environment” and regulatory headwinds in the midst of outpacing its competitors. For example, Kempczinski noted that he saw down traffic with the income group $45,000 and under but it maintained its leadership in “value perception.”

This particular statement from Kempczinski probably caused the initial sell-off at market open:

…there will certainly be a hit in the short term to franchisee cash flow in California.

However, Kempczinski seems to suggest that the California regulatory landscape regarding wage increase is not optimal but that it’s a short-term, “high pricing” impact on the cash flow on the franchisees. From a market sentiment point of view, I believe the current stock price is forward-looking and has priced this news in.

Where does Big Mac go from here?

I believe fundamental outlook is positive enough to go long from its current price of $262. Nonetheless, it needs to overcome several technical hurdles on the chart to see strong momentum.

Here is what I’m seeing short-term:

A strong “Cup with Handle” formation with Handle completion around $262.56 is in process — but with volume hesitancy to break out of this resistance area. It is being rejected multiple times on October 31st and today.

The daily view is playing out as “expected:”

My previous post discussed two possible interpretations of the chart pattern formation: one being a steep Cup with Handle, the other being a Bullish Pennant. The latter pattern has played out thanks to the Q3 results but the Handle completion area is still being tested as of November 1st.

When it solidly breaks out if this range, the next important tests are the weekly 10-MA and 30-MA at $264.71 and $281.12, respectively:

Analysts’ revisions and upgrades post Q3-ER

For what it’s worth, the earnings provided an insight into McDonald’s business trajectory and sell-side price targets and upgrades are reflecting this sentiment, i.e., average PT of $310.42 with 18.19% upside.

My speculation is that MCD has the legs to surge above $295 in the coming months on the assumption that staples rotation is in play leading into the end of the year.

Further, another important date to keep in mind is McDonald’s Investor Update 2023 on December 6th. This event is likely to give an insight into its 2024 business strategy and some clues as to Q4 2023 results before the January earnings call, keeping the company in the news.

Disclaimer: I have a long position in MCD, with OTM calls expiring on January 19, 2024.

sweet, thank you!