The Ozempic (GLP-1) narrative began taking traction on October 4th after Walmart CEO John Furner stated that he was already seeing an impact from the GLP-1 agonists. He stated:

"We definitely do see a slight change compared to the total population. We do see a slight pullback in overall basket, just less units, slightly less calories."

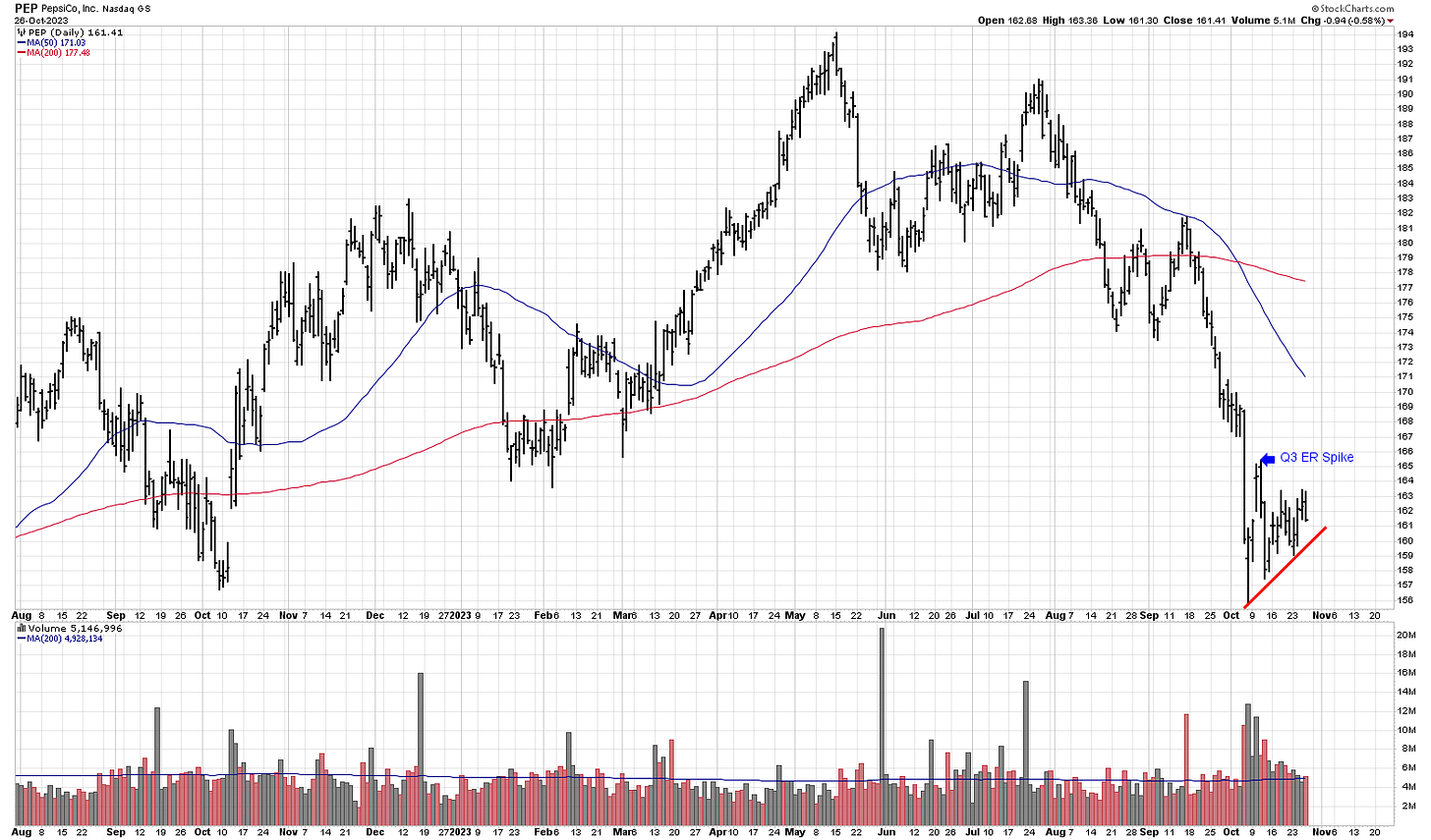

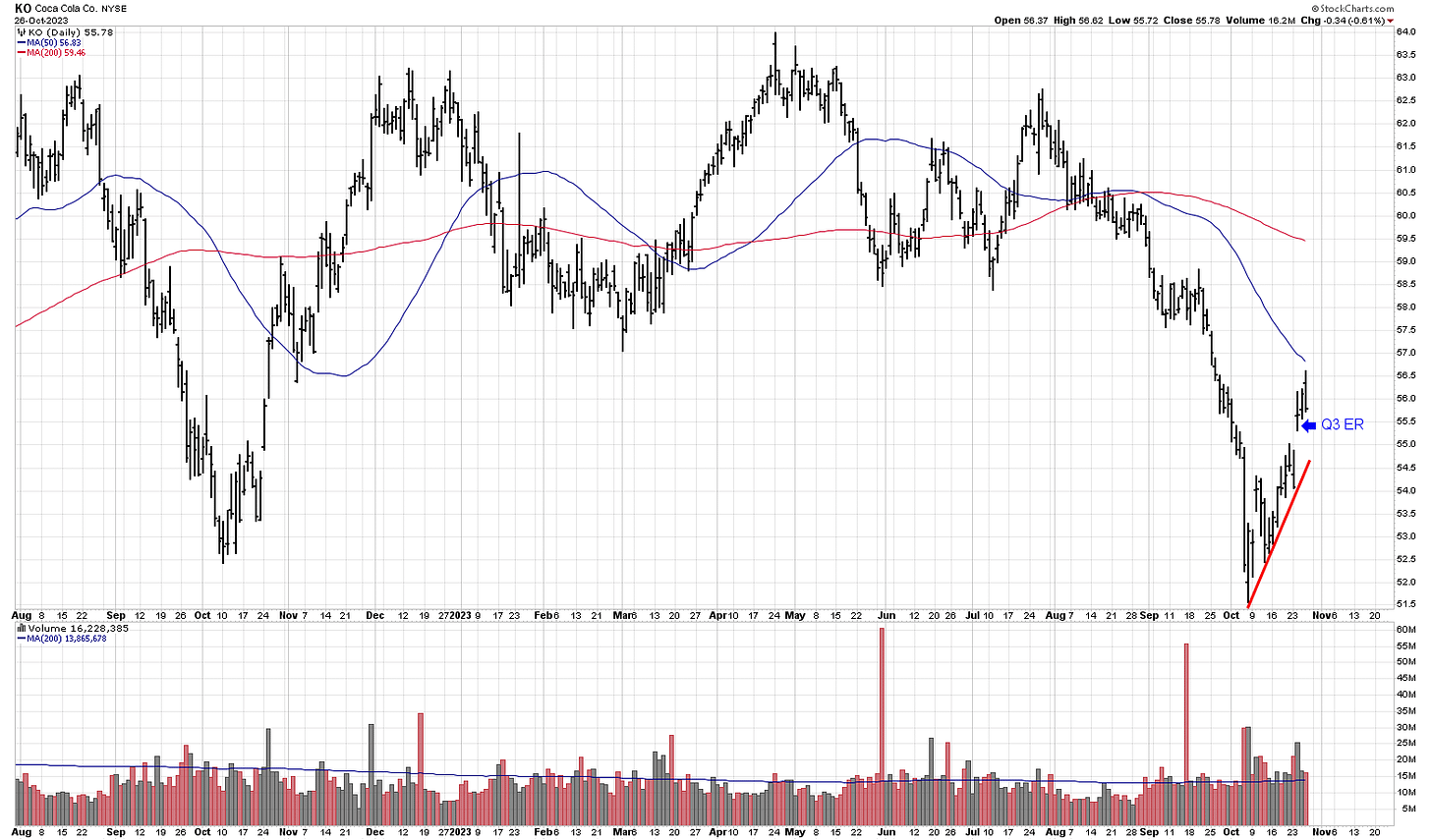

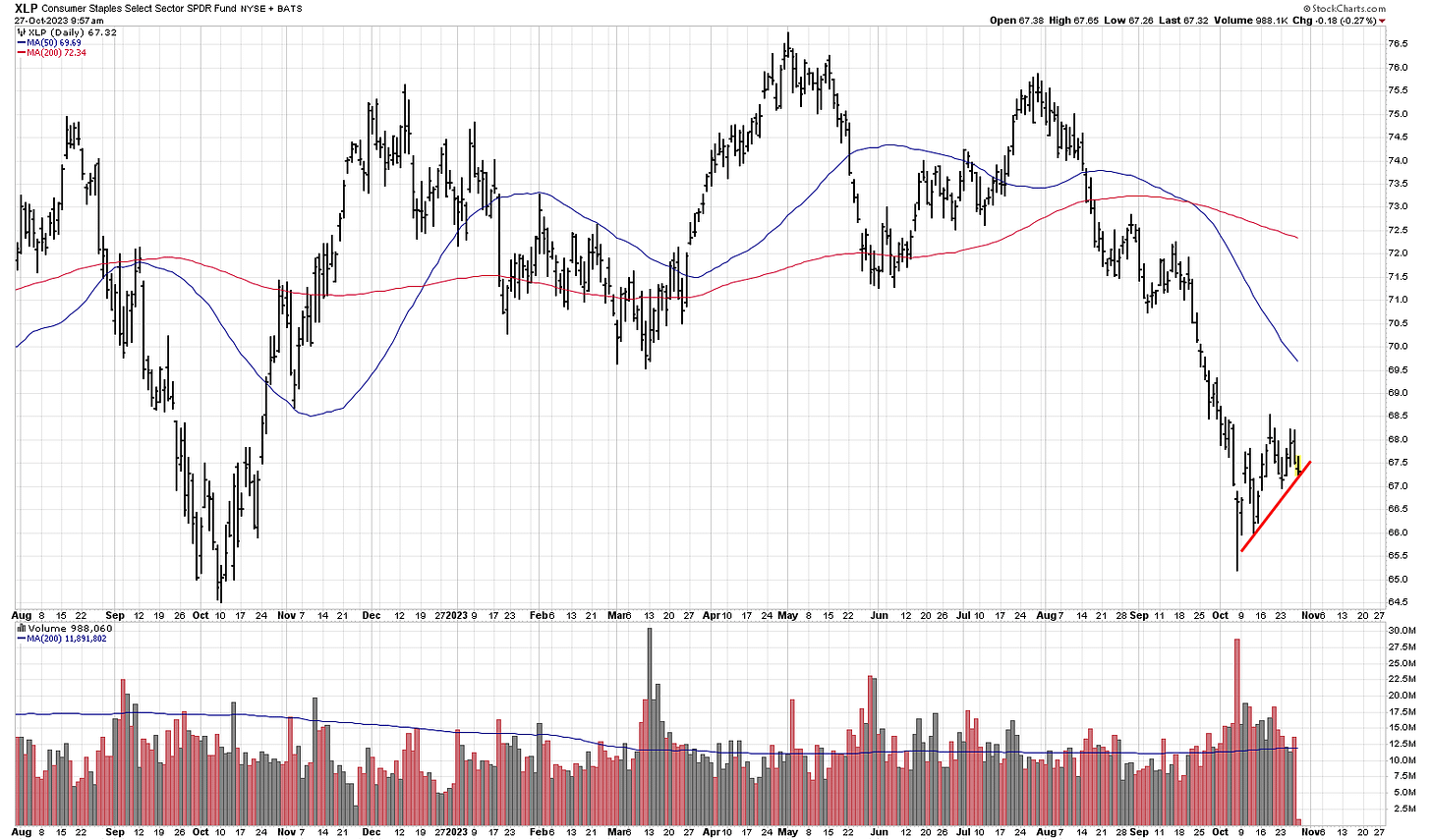

This comment from Furner percolated fear into the consumer staples and discretionary (XLP), particularly in PEP, KO, WMT, COST, and our friend, McDonald’s. Here’s an illustration of the impact subsequent to his comment:

Through the Walmart’s pharmacy unit, the company used anonymized data to analyze the spending habits of its customers who are taking GLP-1 drugs. I’m not challenging the efficacy of the drug but rather critically questioning its immediate, widespread impact on the junk and fast food market in the short term. What is unclear from Furner’s comment is this: what percentage did GLP-1 users make up in the total sample of this pharmacy data? We simply don’t know.

Still, the Ozempic-related fear percolated throughout the market following October 4th, and the damage was already done, gaining steam on the narrative that Americans are giving up on our most celebrated culture of sugar, fast food, and junk.

Signs of GLP-1 narrative disconnect and the opportunity to profit

Since Furner’s comment, the following circumstantial data points have undercut the argument that Americans are consuming less calories on Ozempic and GLP-1 drugs for now. Again, in my view, it’s a small sample that does not represent the American consumers as a whole due to GLP-1’s high cost, i.e., $1,000-$1,500 per month for injection.

Pepsi ER on 10/10/2023. Top and bottom line beats with CEO noting that the impact of Ozempic and Wegovy has been “negligible” so far.

Coca-Cola Q3 ER on 10/24/2023. Similar to Pepsi, it had a double beat with earnings surprise of 7.25%. Coca-Cola CEO explained how the company outmaneuvered Ozempic for weight loss because Coca-Cola has been offering low-calorie options for years, and GLP-1 drugs are having a minimal impact on the company’s performance.

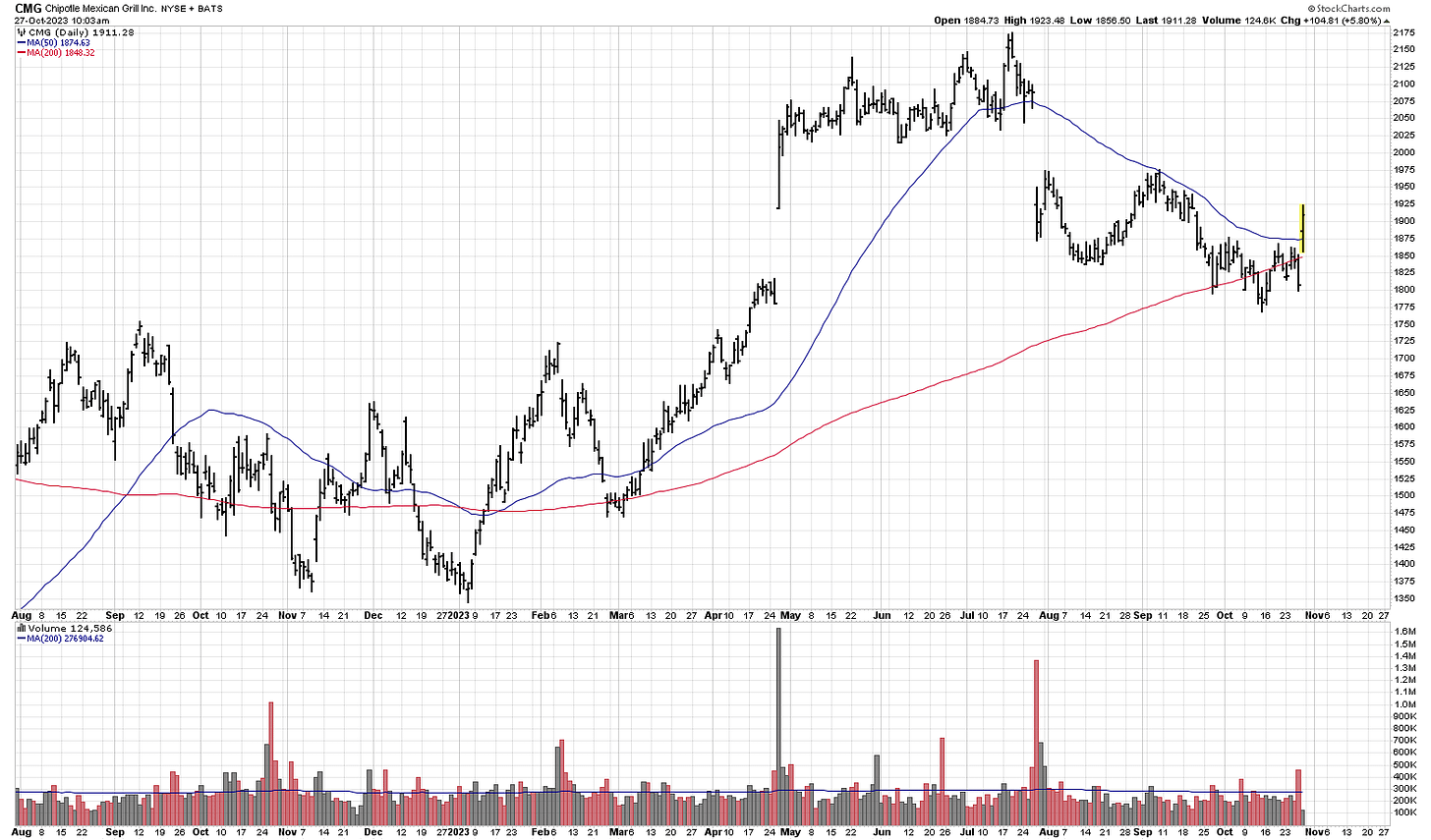

Chipotle Q3 ER on 10/26/2023. Chipotle delivered adjusted EPS of $11.36 in Q3 compared to $9.51 in the prior-year quarter. Its EPS came significantly higher than the $10.55 EPS estimate, a double beat expansion. CMG CEO’s commented that it offers a variety of “clean” food that makes it a “good solution” for a growing number of GLP-1 users.

XLP as of 10/27/2023. XLP, a consumer staples ETF, is demonstrating a similar trend compared to the aforementioned names.

S&P 500 Heat Map. There’s a possibility that rotation into staples are in play, but I believe another week or two covering strong earnings derived from consumer spending in the fast food sector will solidify this trend leading into the end of the year.

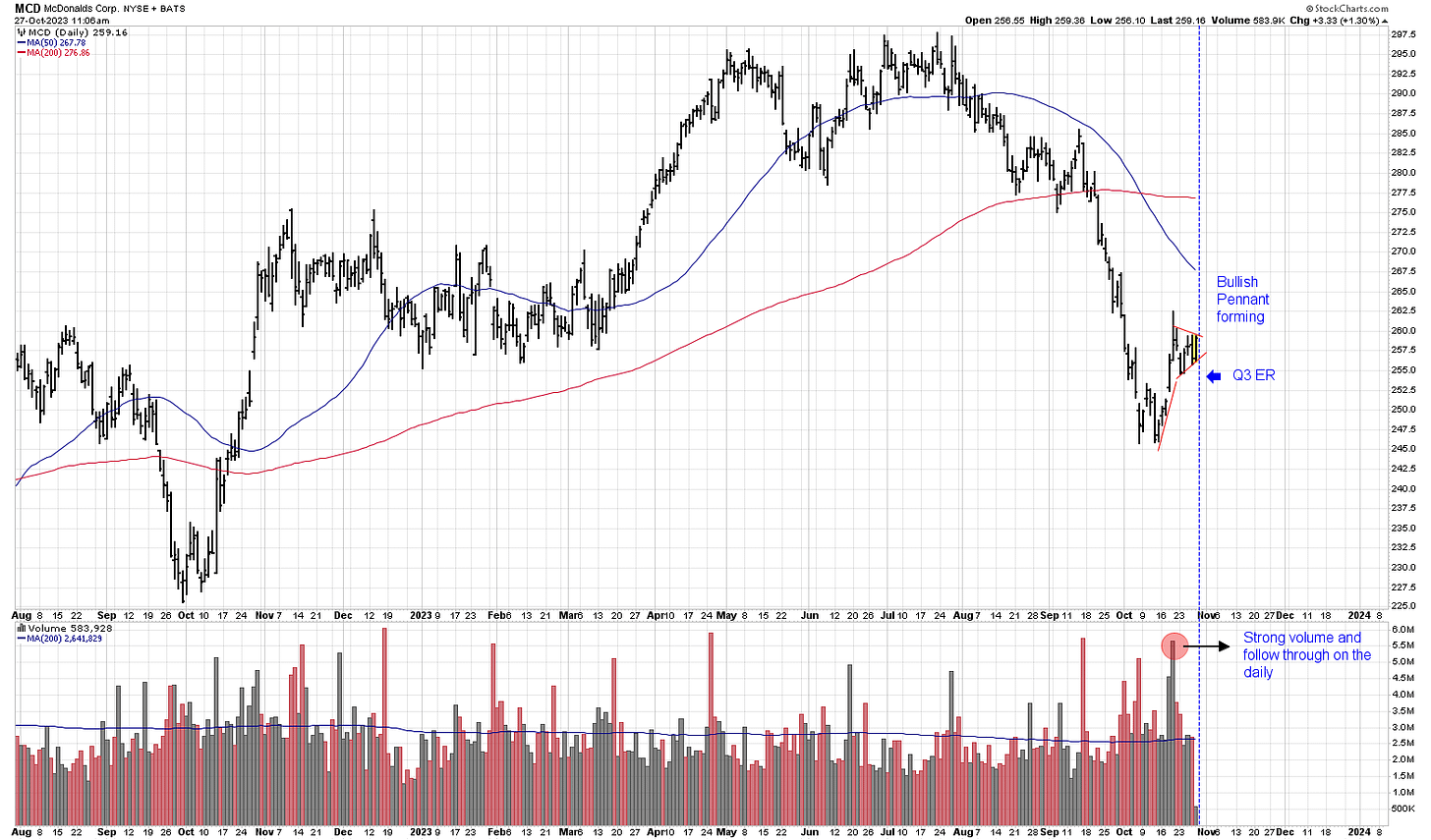

McDonald’s Q3 on October 30, 2023 – Before Open

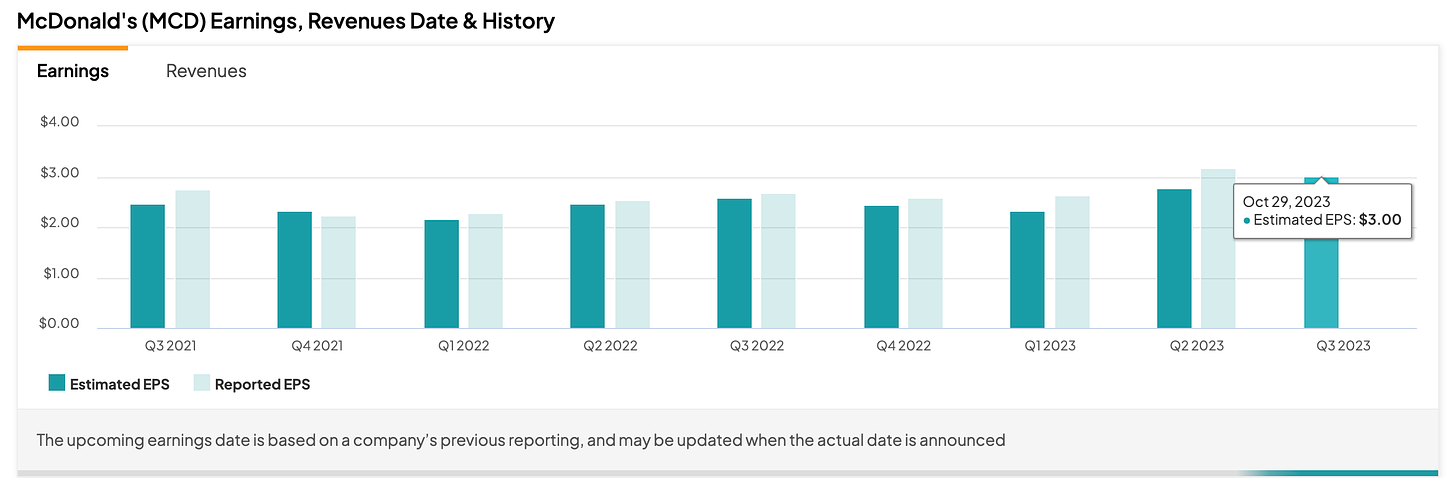

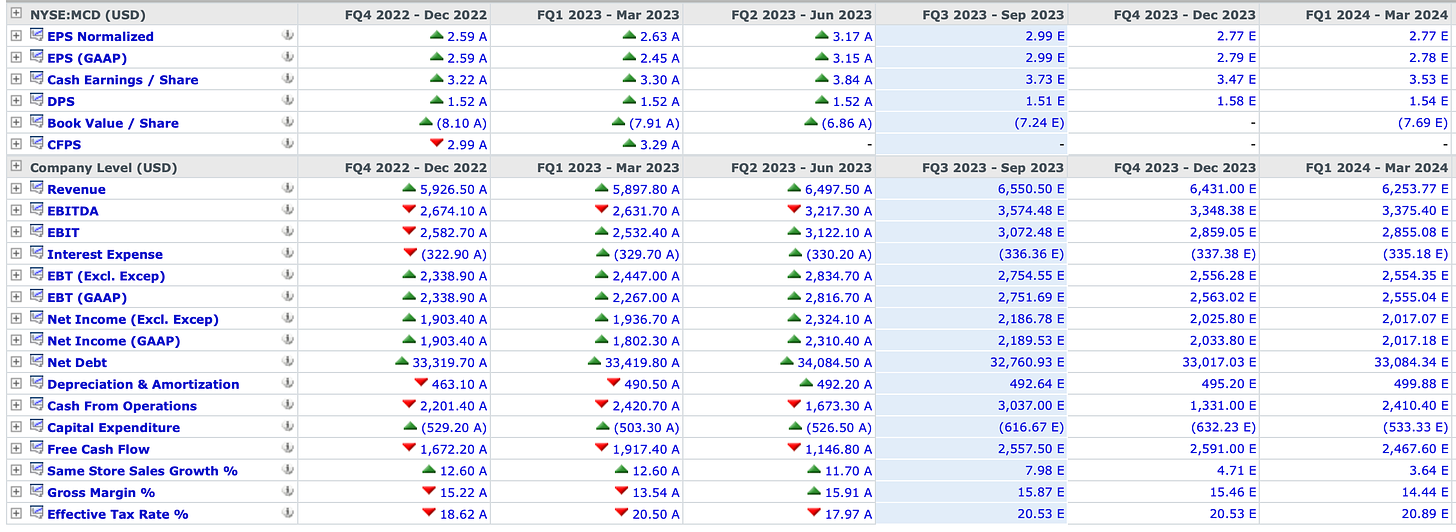

It’s my view that the market is grossly underestimating MCD’s EPS estimates, simultaneously, overestimating the impact of Ozempic. See below for the EPS historical results beginning with Q3 ‘21.

The consensus is $2.99 EPS and $6.55B in revenue and I’d argue that it will likely come in the upper range of the estimates due to Q3 seasonality covering back-to-school, often prompting November to be its best month in the last 20 years: I am just eyeballing here but I’m expecting MCD to post at least $3.15 EPS and the Q3 revenue to be about 1% above the consensus around $6.6B.

Further, I do not put much emphasis on the sell-side analysts. Still, they’ve awfully bullish with a mean PT around $314.30. My rule of thumb has been to apply 5-10% discount to their mean and median PTs:

Some may argue that current price of $257.77 pinning P/E at 23.6x is still too “expensive,” but this is an antiquated metric to look at a business that is succeeding at YoY same store sales growth incorporating digital penetration with their flagship mobile app.

If Chipotle’s Q3 ER is of any guidance, it’s more than likely that McDonald’s will solidly beat this quarter’s expectations, in line with their consistent focus on increasing dividends year after year.

Further, if it can provide an upbeat guidance leading into the end of the year at the Q3 ER call, as well as some commentary on the negligible impact of GLP-1 on their revenue, I believe McDonald’s presents an opportunity for a decent trade that could surge above the illusive $300 resistance and form a base there in the coming months. In the same vein, I’d also make the same argument for XLP.

Disclaimer: I have a long position in MCD, with OTM calls expiring on January 19, 2024.

great DD, thank you!