$MCD Trump's McDonald's

Technical Attributes Collide with Political Seasonality, Yet Again

Short-term trading opportunity for Q1 ‘25

I tend to trade what I know, even if it’s boring.

If you’ve been following me, I may have alluded to cracking McDonald’s options as both a mysterious and rewarding endeavor. The options chain benefits significantly from being heavily owned by institutions, where large block orders often exert Vega upon execution, frequently causing massive premium hikes. For example, McDonald’s is currently trading at $283; it does not need to “squeeze” to make this a profitable trade. It simply requires a 5% move within a reasonable timeframe.

I believe another trade is brewing as it is consolidating near its key areas.

MCD daily chart with key MAs

As with other consumer discretionary stocks, such as Domino’s Pizza (DPZ), McDonald’s tends to fill nearly “every” gap and test its key moving averages. In this case, the daily SMA-200 happened to overlap with the gap left on August 19th, which was filled on January 14th. Since then, it has been in consolidation. The E. coli outbreak news dampened momentum on November 13th, and McDonald’s has been attempting to break out of that area ever since. However, I am placing significant weight on the fact that it bounced off the SMA-200 on January 17th.

OTM Calls for 2/21 and beyond

When trading options, the anticipation of unknown future events causes implied volatility (IV) to rise, the main variable that prices the contracts. The days leading up to earnings for McDonald’s tend to see IV increase exponentially as we approach the premarket release, which, in this case, is on February 10th. Here, the $285 calls for February 21st are showing some volume covering the earnings. Notably, large blocks of orders came through around 11 a.m. today (1/23), giving the buyer a two-week window to purchase the contracts at a nullified premium, i.e., cheap now.

MCD weekly chart

Even as a short-term trader, I’d argue that focusing on the weekly timeframe is likely more critical than the daily timeframe, particularly for a DJIA component. This is because institutional holders tend to rely heavily on longer timeframes for their analysis when deciding whether to hold a position, and fundamental theses take time to materialize.

My “Secret” Sauce: Bollinger Band on weekly

The Bollinger Band (BB) is one of my go-to indicators for entries and exits. More often than not, entering at the bottom of the BB has generally resulted in trades where the reward outweighs the risk.

McDonald’s is currently hovering and consolidating at the bottom of the weekly Bollinger Band chart, which is my signal to enter.

If you examine the chart above, you’ll notice that MCD tends to oscillate between the lower and upper bands before breaking out. Furthermore, it generally takes at least 8–12 weekly sessions to move between these two ranges. This insight can guide how to construct the options strategy.

In this case, I prefer to give at least 90-days to expiration, i.e., 12-weeks, though the February bull trader has opted for February contracts. I’d also point out that the downside risk is quite tempered for the time being.

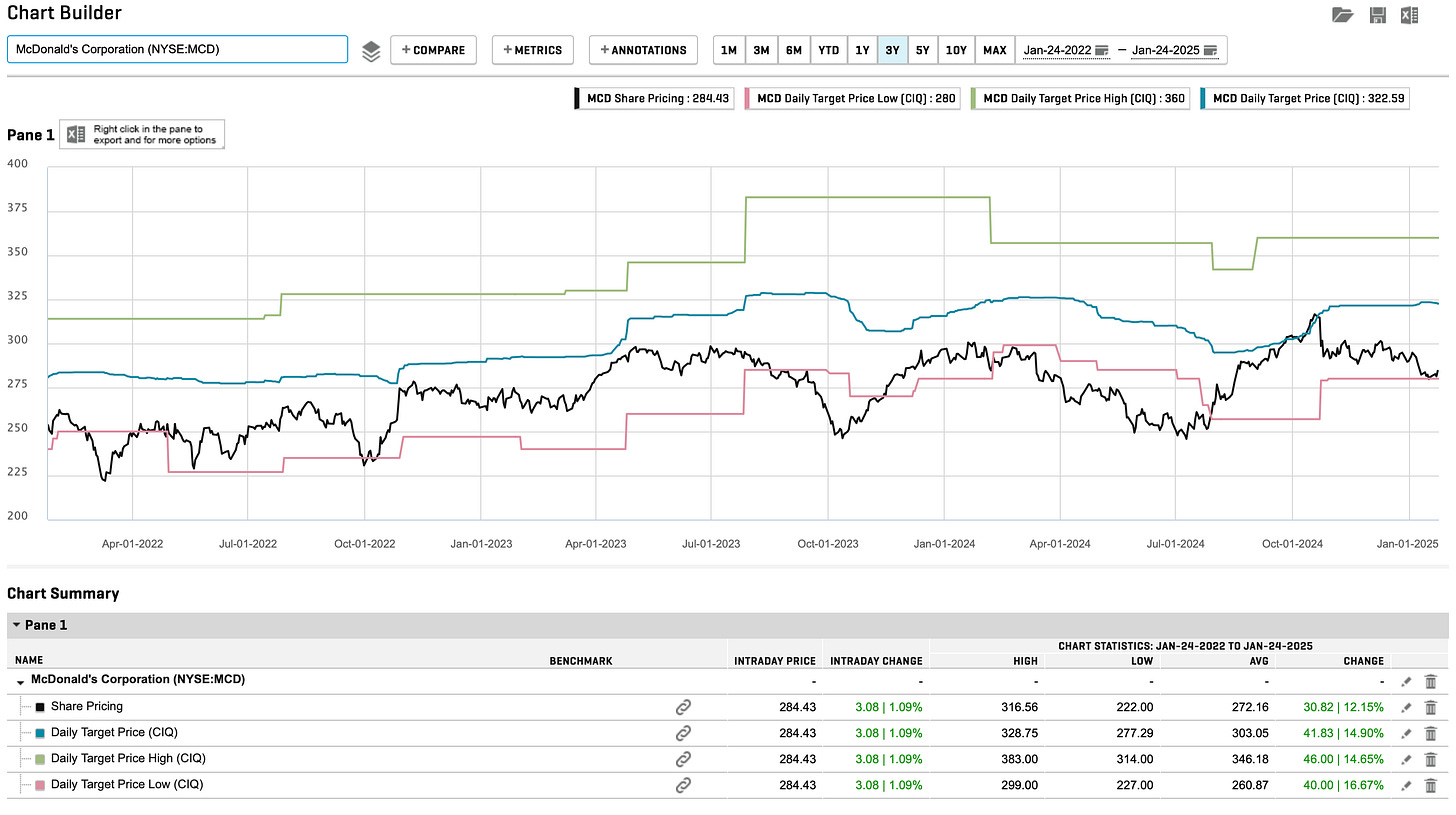

Capital IQ CIQ on McDonald’s

Throughout the years, I’ve used Capital IQ CIQ data to configure my strikes along with my expected timeframe. See below:

McDonald’s is hovering near the bottom range of the CIQ at around $280, while the CIQ median target suggests a price of $322.

I personally do not believe it will reach $322 but find it plausible for the price to approach the average of these two points, around $301, within the next 12 weeks.

Another important consideration when choosing an options strike is to allow some wiggle room in case the target is not reached. You can do this by either buying an at-the-money strike or selecting a strike a few points below your target. For example, in this case, $300 is a significant psychological barrier, so I’d prefer the $295 strike.

For whatever reason, the biggest risk from a market structure standpoint is breaking below the daily low of $276.53 from January 16. For me, this is where I would place my stop.

Fundamental and Market Hopium

There’s a lot to cover on the fundamental side of the business, along with the political factors that could impact price action in the short term. I’ll dive deeper into this in the coming days. Stay tuned.

Thanks for reading.

thanks for the trade. i appreciate it