May-June '24 Market Update

Broadview watchlist for the coming weeks

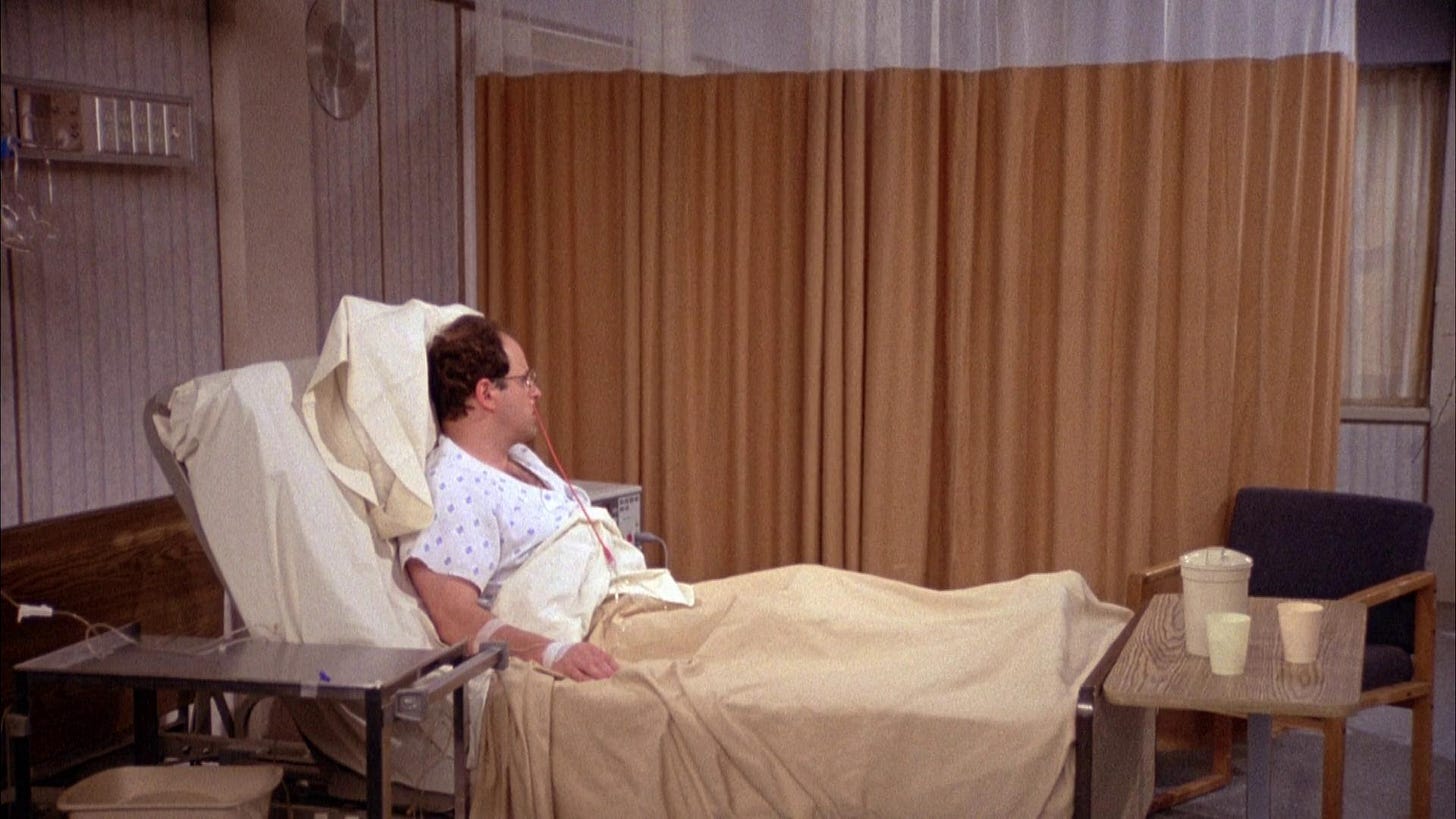

It’s been awhile since I’ve updated my last post on Starbucks. I’ve been battling cancer over the past several months and had to take a break from any activities that would increase my blood pressure. The doctor said to stay away from the market, literally! Regardless, I had a successful surgery, am now in recovery, and am attentively watching the market for decent short-term setups.

Starbucks Debacle Post-Q2 Miss SBUX 0.00%↑

The last two earnings results caused a mass market sell-off coupled with its CEO’s inability to counter the market narrative after the Q2 miss. I took a loss after Q1 earnings and didn’t hold a position going into Q2.

It’s still too early to tell whether the reversal has occurred on the weekly chart and if its horrid market outlook is priced in. I do believe there’s a short-term trend to go long, but it’s more than likely to be met with resistance at the “Covid Low” trendline, i.e., around $85. This could pose a decent trade to keep the strike extremely close to the current trading price at a $75 strike; conversely, OTM strikes are for selling.

Current Watchlist for Options

GoodRX GDRX 0.00%↑

A ton to like about this stock fundamentally on the business side. It is moving on strategic partnerships with large retail chains, such as Kroger. It’s a category leader gaining market share and has an ambitious financial targets for the coming years. The management wants $1B in revenue and more than a 35% adjusted EBITDA margin. It is also building upon a nice looking Cup with Handle. I plan on going long on a minimum 45-DTE calls upon $8.52 break.

Walmart WMT 0.00%↑

Simple: the trend is your friend, and Q1 ER knocked it out of the park. The market share expansion in groceries is notable, given the high cost of food for most Americans. The mention of also garnering higher-income earners as customers sheds some light on the consumer shopping trend. All in all, the superb ER results triggered higher PT revisions by sell-side analysts, with the median PT around $70. It’s currently trading at $65, and low-IV proposes a decent LEAPS configuration. A true ATM LEAPS could be wonderful here in lieu of shares, especially configured with high delta.

Oscar Health OSCR 0.00%↑

Oscar Health recently broke out of its multiyear Cup with Handle, but it seems to want to base around the Handle breakout area or WMA-10. This is receiving institutional support as of late with strong above-average volume. Oscar is set to discuss its 3-year strategy with financial targets at its upcoming Investor Day, focusing on future growth opportunities. The key here is its strong enrollment growth, as well as its solid Relative Strength. I think it’s slightly early to get in, but I’d like to see it test WMA-10 first before going long. The options chain is also robust. Watching for basing and consolidation on the weekly chart — $20 strikes with at least 90-DTE.

All in All…

I’m still alive and well. Hopefully, I’ll be able to update more regularly. Until then, please enjoy the sun on my behalf.