H1 '25: In Greed We Trust

Trading in the Trump era

As with any new administration entering office, volatility accompanies every new term. But this week was more eventful than most. A myriad of Trump’s executive orders brought havoc to Washington, including directives to explore a “digital asset stockpile,” order the creation of a cryptocurrency working group tasked with proposing new digital asset regulations, and investigate the establishment of a national cryptocurrency stockpile. To some degree, he’s “keeping” his campaign promises.

Paulsen’s “Walmart Recession Signal”

Before diving into my favorite “recession index,” I want to point out that reading about macroeconomics is one of my favorite pastimes. That said, I take what I read from other economists with a grain of salt. They don’t usually know either—but they sure do sound smart in their writing.

“If you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” - Peter Lynch

I’m firmly in the Lynch camp, believing that trying to predict recessions, interest rate movements, or other large-scale trends rarely leads to investment or trading success. Lynch emphasized that some of the best opportunities arise when the market is gripped by macroeconomic fears or during recessions, when good companies are undervalued. If you want to dive deeper into Lynch’s views on focusing on what you can control, One Up on Wall Street is a must-read—even 30+ years later, as human nature remains unchanged.

That said, one of the more unusual market signals right now is what Jim Paulsen refers to as the “Walmart Recession Signal.” The concept is simple: it’s Walmart’s stock price divided by a luxury index. And at the moment, it’s flashing a clear warning: “recession!”

The chart above highlights that periods of Walmart significantly outperforming luxury-focused companies often coincide with rising corporate bond spreads. A widening spread reflects increased risk aversion, a hallmark of economic stress or looming recessions. If Walmart’s stock is surging while junk bonds are sinking, the recessionary concerns voiced by some economists are not without merit.

Conversely, this divergence might also suggest that Walmart’s new business strategy is paying off. Meanwhile, other recession-friendly retailers like Dollar Tree (DLTR) and Dollar General (DG) are struggling.

Frankly, the recent employment data has muddied the Fed’s rate cut outlook, but I plan to trade short-term momentum in either direction while keeping an eye on the VIX.

Earnings I’m closely watching: DKNG & RL

DraftKings (DKNG)

While it may be a legislative trade in the long term, the weekly chart shows momentum building around DraftKings, particularly following Netflix’s stellar Q4 earnings. Netflix added 18.9 million paid subscribers—the most in its history—pushing it past the 300 million mark. Notably, this growth was partially driven by a one-off live event, the Paul-Tyson fight.

Even if the NFL delivered customer-friendly results, DraftKings profits from losing bets. With Tyson “losing,” I’m inclined to believe the company delivered positive results, in line with Netflix’s Q4 performance. It’s been a bumpy ride, but I remain bullish going into its earnings on February 13th.

Technically, it tested the inverse head-and-shoulders neckline at $42 this week — and was rejected. This typically indicates that the market is aware of this level. Therefore, upon an upside breakout, I believe it will act as a springboard when the time comes.

Ralph Lauren (RL)

I don’t usually discuss trades I missed, but the tickers often earn a spot on my watchlist.

This is because I can either enter the trade on momentum (“buy high, sell higher”) now or wait for a consolidation phase while it oscillates between two levels.

During one such consolidation in December after the election, I came across a picture of Kai Trump standing with Don himself, wearing Ralph Lauren’s American flag sweater.

A few days before the holidays in December, I visited one of the Ralph Lauren outlet stores in Woodbury, New York. The scene was both fascinating and baffling. The store was packed with tourists from NYC, eagerly grabbing specific items, particularly Polo Bear products and Americana-inspired sweaters.

While the “old money” look has been trending since the show Succession, I’d argue that Trump’s presidency has coincidentally boosted the “old money” Americana trend—driven more by political insignias than the preppiness that defined the brand in the 80s. The Bear Polo trend will eventually fade—only to return cyclically—but for now, I don’t see it losing momentum.

In my view, this is a premier brand that appeals to a distinct clientele, setting itself apart from the likes of Gucci and Louis Vuitton.

Q3 Earnings on February 6

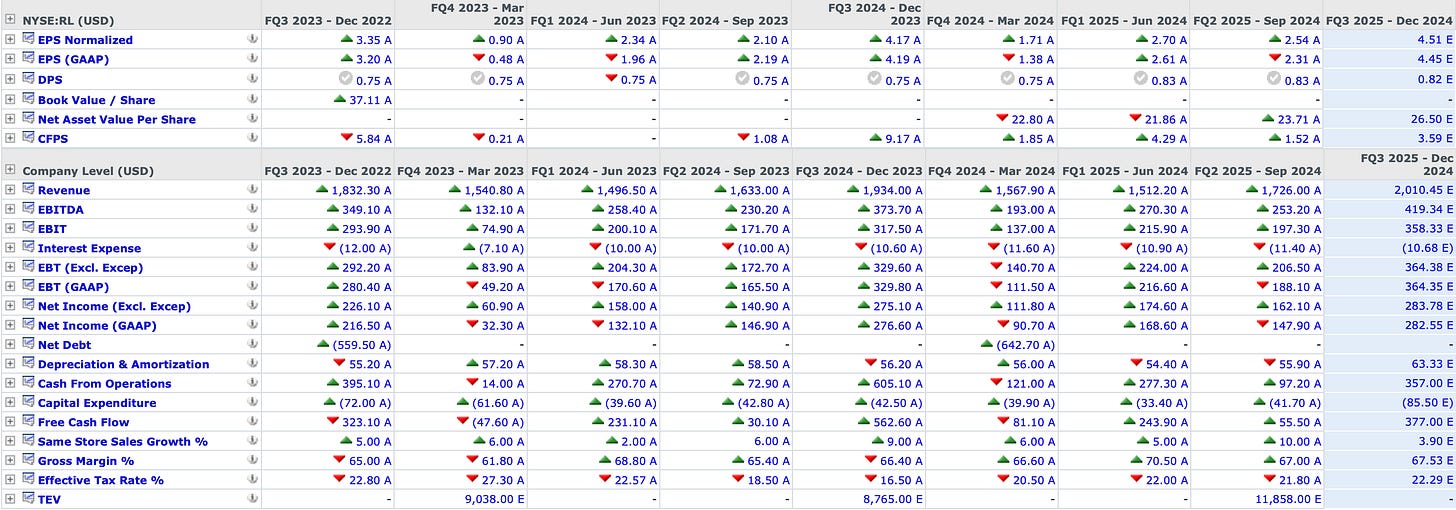

I’m expecting a solid beat that covers a strong holiday season. I will dive more deeply into the fundamentals at a later point but please see the Capital IQ estimates going in:

The expectations for earnings are high at around $4.51 per share; however, the focus will be on its FY guidance, which I anticipate will either be raised or at least adjusted.

I’m slightly hesitant to go long before earnings, primarily because it’s trading above the CIQ mean. Nonetheless, its PEG ratio remains on the healthier side at 1.89x.

All in all…

Both DKNG and RL offer decent trading opportunities, in my opinion. DKNG might be a solid earnings play, while RL appears to be a longer-term hold. Fortunately, RL’s options liquidity has improved significantly over the past year, making LEAPS an attractive consideration as well.

Thanks for reading!

- G