Build-A-Bear Workshop v2.1: Position Update & Technical Benchmark

$BBW: Weekly Technical "Cliff"

Current Positioning: NONE

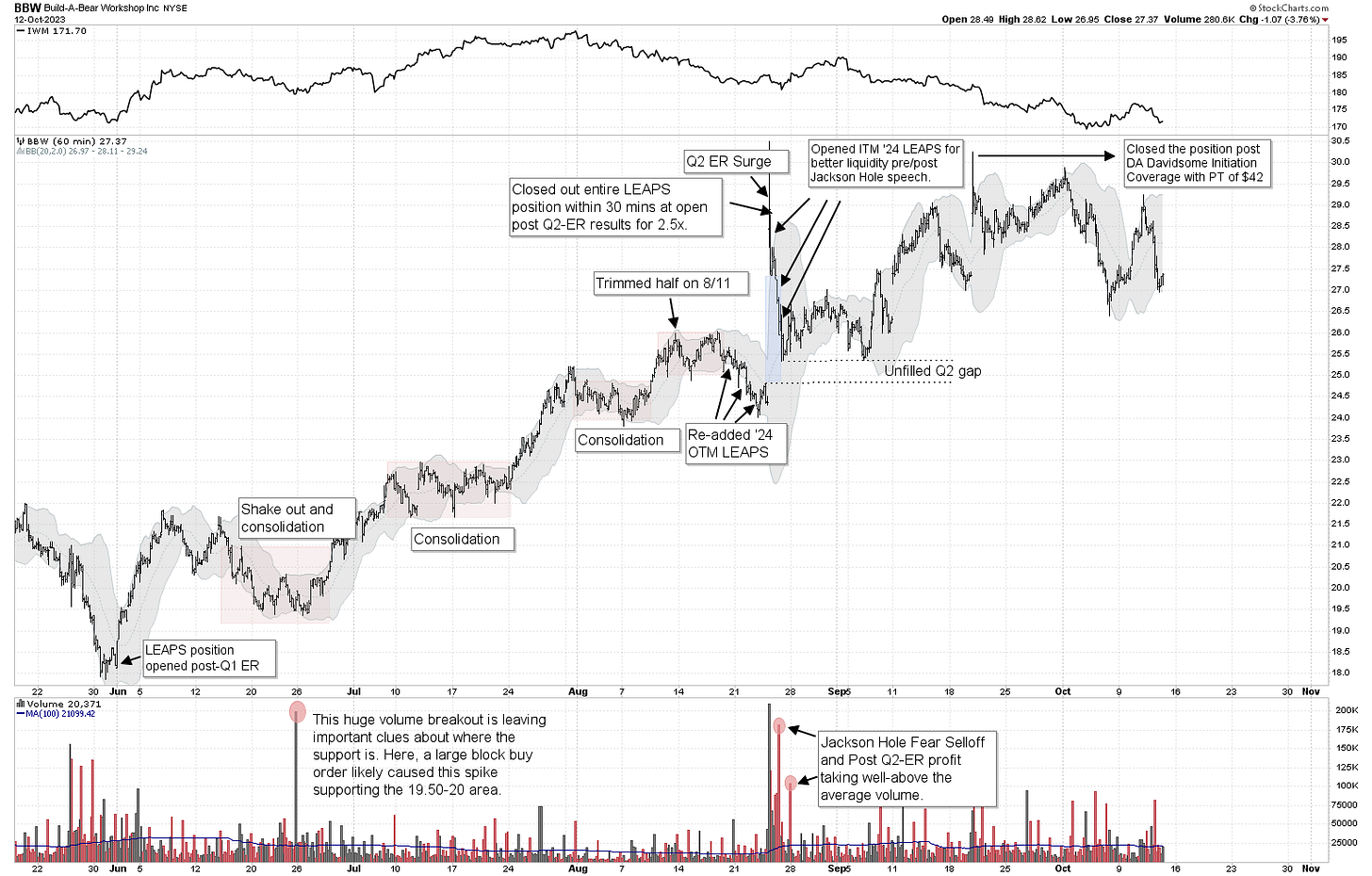

In my previous post on Build-A-Bear Workshop, I disclosed that I held long call positions expiring in January 2024. Since that post, I’ve closed out my position when DA Davidson’s initiation coverage of the company with a $42 PT caused a massive spike in mid-September.

Always sell on the news when it causes an irrational spike.

I’ve learned the hard way that it’s best to sell a small float, small cap position when a new sell-side coverage is able to spike it 15-20% on the news alone. This is less of an issue for mega-caps but these types of spikes on small-caps are more often than not a signal to exit the position. This is because more sophisticated traders with larger positions are able to liquidate their shares – without cannibalizing the share price – at the expense of novice traders who are just entering the trade based on the “positive” review of the company. As the idiom goes, it’s best to add when no one is talking about it.

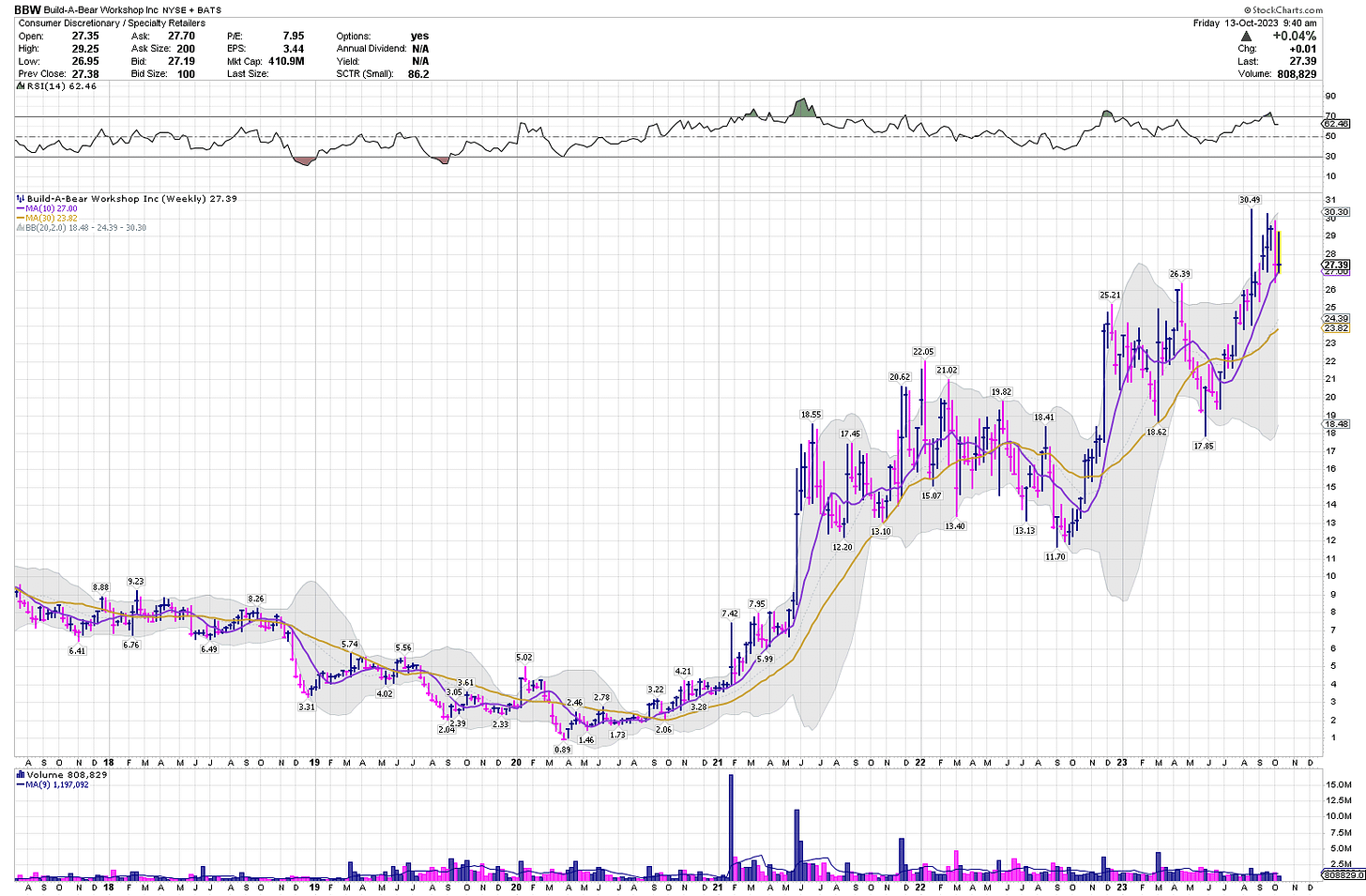

Paying close attention to Weekly MA 10 and volume

Many years ago when I started out incorporating technical analysis into my trading practice, I made the grave mistake of relying solely on the daily charts and their 50 and 200 days moving averages (MA). What I didn’t know then was that large institutions relied on 10 weekly MAs for their buy point, and vice versa, a harbinger for exiting their position.

Case in point. BBW is supported by weekly 10 MA at the moment at $27. Make no mistake because it’s the large institutions holding this precarious spot. If it settles at any point below WMA-10 with increasing volume, this is likely a decent time to lighten up the position. More often than not, the large holders are distributing around this area and it does not take much on their end to move this small float.

I’m fundamentally bullish on this company but I cannot let the technical guard down just because I love their products and the company. A novice mistake.

When in doubt, sell or lighten up when increasing volume breaks down the Weekly 10 moving average support.

interesting setup, thank you!