2025: The Year of Grift and Volatility Juice

The White House will spearhead the bluster pack

First, happy new year and wish you all the best in 2025 in the market and in your personal endeavors. I have not been able to update more frequently the last few weeks due to the end of the year work required in transitioning from my current role to another at the beginning of the year. Thank you for your patience.

This year in the market is likely to be driven by “Wag the Dog” headlines, potential adverse data challenging the Fed’s efforts to achieve its dual mandate, deregulation, and massive inflationary spending bills poised for passage — shaping up to be a wonderful year for volatility traders.

“Ah shit, here we go again.”

Speculating on the Spooz’s exact year-end target is, in my experience, a fool’s errand. However, we can still gauge—at least circumstantially—how volatile this year might be under the new administration. From my perspective as a legislative counsel in Washington, the first few months post-inauguration often prove euphoric, with promises of new spending bills passing and the uncertainty of the election season coming to an end, potentially resulting in a “relief rally” for a few weeks. That said, I agree with ex-Fed counsel, Joseph Wang that, at least for now, legislative policies seem secondary to the Federal Reserve’s actions and options flows.

Even without the “Santa Rally,” the U.S. indices have demonstrated a broad-based rally, with all S&P 500 sectors recording weekly gains. However, this optimism is somewhat tempered by caution among asset managers. With equity valuations soaring in growth tech, firms like Vanguard have advocated for a defensive portfolio stance, increasing allocations to fixed-income assets. For example, Berkshire Hathaway has adopted a similar approach this year, raising capital by significantly reducing its positions in Apple and Bank of America. This possibly reflects concerns over potential market corrections — and the limited capacity for further interest rate reductions by the Fed.

Spending spree with a George Soros acolyte

"Look, the United States is not going to default on its debt if I'm confirmed. But I will tell you that, for people who don't understand the debt limit, it might be like taking out your handbrake in your car, that you can still hit the brakes, but it's one less feature."

— Scott Bessent, U.S. President-elect Donald Trump's nominee to be Secretary of Treasury

Complicating the Fed’s monetary policy outlook are additional fiscal and trade pressures. Trump’s proposed tax cuts and increased tariffs, combined with Scott Bessent’s statement during his confirmation hearing about collaborating with Congress to eliminate the U.S. debt limit, could further exacerbate challenges to the Fed’s rate reduction cycle.

The IMF has also issued warnings about potential inflationary pressures arising from Trump’s economic policies. These measures could stimulate demand while constraining supply, leading to increased inflation. Such a scenario might compel the Fed to reassess its interest rate policies, potentially delaying planned rate cuts. While this remains an oversimplified speculation on the new administration’s policies, what we do know is that it’s likely to be a promising year for volatility traders!

Shitcoin Mania

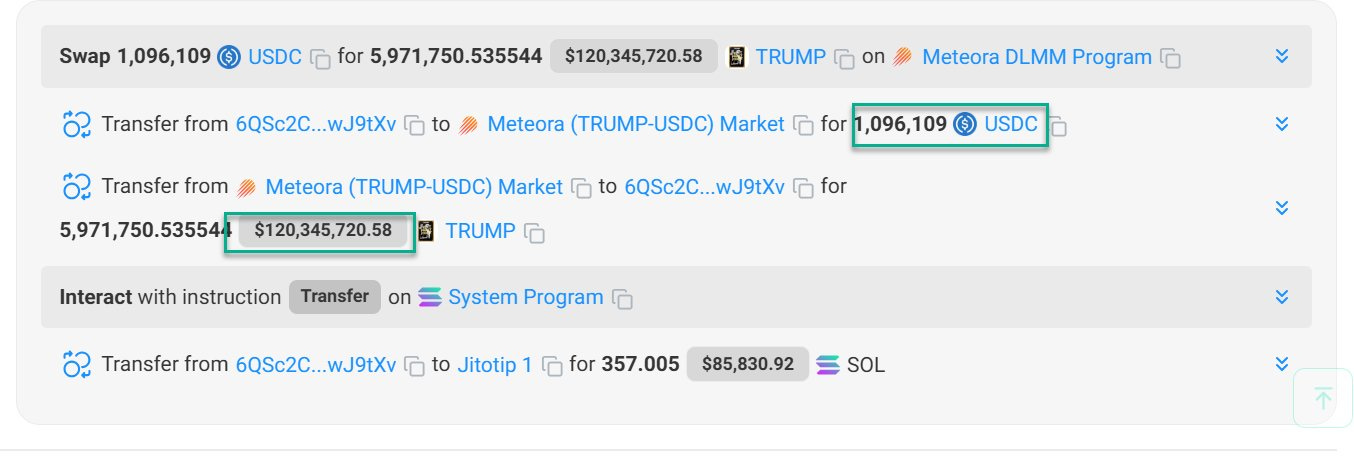

Case in point, here’s the U.S. President-elect shilling his own memecoin, $TRUMP, on January 17, 2025, just days before the inauguration — a moment destined for the history books of grift.

By mid-morning on January 18, the market capitalization had exceeded $30 billion — and $70 billion by January 19th morning. The coin’s official site stated that 200 million meme coins had been issued, with an additional 800 million to be added over the next three years. For example, one individual bought $1 million into $TRUMP and turned it into $120 million within a few hours. Not to mention 80% of the float is owned by one unknown wallet. A grifter’s paradise, indeed.

This is just a small glimpse of what’s to come in the regulatory landscape. Many agencies that traditionally protect investors and consumers, such as the SEC, FTC, and CFPB, are likely to be weakened under this new executive branch — creating the perfect conditions for a repeat of the Dutch Tulip Mania. Many will lose fortunes chasing quick returns.

Trump’s crypto mirage

During his 2024 campaign, he pledged to establish the United States as the “crypto capital of the planet” and proposed creating a strategic Bitcoin reserve — mere bluster, in my view, and a topic for another day. Trump also nominated crypto-friendly individuals to key positions, such as former SEC Commissioner Paul Atkins as the new SEC Chair, replacing Gary Gensler, who is stepping down. Additionally, venture capitalist David Sacks has been appointed as the White House AI and Crypto Czar, tasked with developing a legal framework for the cryptocurrency industry. Notably, the industry donated at least $10 million to Trump’s inauguration fund in a bid to “kiss the ring.”

A lax crypto regulatory environment could lead to significantly heightened volatility as institutional traders shift from low-turnover assets to speculative positions fueled by hearsay. Once again, this is great news for VIX traders.

The Fed is stuck for 2025

In the backdrop of these pending regulatory changes, the Fed finds itself navigating a complex and precarious landscape, especially when Chairman Powell has to deal with very public discourse with Trump. Tasked with its dual mandate—maintaining price stability and promoting maximum sustainable employment—it must also contend with the day-to-day bluster excreting from the White House, which shapes public sentiment and market reactions.

Notably, the administration’s “Project 2025” includes proposals to merge key regulatory bodies and potentially “abolish” the Fed, advocating for a return to a commodity-backed dollar. While such drastic measures would require legislative approval, the administration’s stance indicates a potential shift toward a reevaluation of the Fed’s role.

Additionally, the administration has expressed a desire to directly influence monetary policy. Trump has suggested that the President should have a say in Federal Reserve interest rate decisions, raising concerns about the central bank’s independence. Although Chairman Powell publicly rejected this idea, such a perspective could create tensions between the executive branch and the Fed, particularly if policy directives conflict with the Fed’s assessments of economic conditions — an almost inevitable outcome.

The administration has embraced expansionary fiscal measures, including significant tax cuts, increased infrastructure spending, and substantial tariffs aimed at bolstering domestic industries. The tax cuts, for instance, have led to a ballooning federal deficit, which the Congressional Budget Office projects to reach unprecedented levels in the coming years. This fiscal expansion exerts upward pressure on inflation, complicating the Fed’s efforts to stabilize prices. At the same time, tariffs and trade restrictions, another hallmark of Trump’s policies, disrupt supply chains and raise production costs, further fueling inflationary pressures. Thus, if macroeconomic data points to inflationary pressures creeping back up, the Fed will be stuck, forced to put the brakes on lowering rates. In fact, it might even compel the Fed to double down on its quantitative tightening efforts.

As a side note, this is a fantastic book that illustrates the Fed’s role behind the scenes as a clandestine volatility seller through its trading desk operations and indirectly stabilizing the broad markets.

![The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis[Book] The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis[Book]](https://substackcdn.com/image/fetch/$s_!nOD7!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9d05ee86-5d30-4752-8d56-4bf0d3431f41_1200x630.png)

All in All…

This year is likely to be driven by headline bluster that impacts both volatility and the Fed’s policy directives. While the old value mantra of buy-and-hold could still work, it might require a “coffee can” approach to investing—essentially, setting it aside and forgetting about it. Despite the despondent outlook I’ve outlined for the regulatory space, this environment also presents an opportunity to closely monitor headlines and anticipate broad market movements in the short term. One of the first steps an options trader should take is to focus on both the VIX and VVIX before individual names, in conjunction with tracking 10-year yields.

Best of luck to you all — and godspeed.

Fridays are going to be interesting George. Time to brush up on selling options.

MVGA (Make Vola Great Again) ;)